A sector hit hard by inflation and geopolitical tensions

Having just emerged from the supply crisis caused by the Covid pandemic, the agri-food sector was again disrupted by a number of events in 2022: firstly, the energy crisis and the increase in raw material costs caused by the war in Ukraine, which gradually spread to the entire industrial landscape and caused an inflationary surge, exacerbated by labour shortages in certain sectors (notably transport). Finally, the animal health crisis (with recurrent outbreaks of avian flu) and an unprecedented drought in Western Europe contributed to spectacular increases in the prices of certain commodities and agricultural products.

In December 2022, food prices are estimated to have risen by 12% compared to January 2021, with peaks in certain product categories: +60% for oils, +20% for pasta, +16% for poultry, etc.

The latent energy crisis combined with the war in Ukraine has indeed had a direct impact on energy prices. As the price of electricity continues to rise, the French government has taken measures (price caps for companies) to limit this increase (+120%), which would otherwise have led to an even steeper rise in companies’ energy bills (as in England). As for natural gas, its price has doubled (+103%) between the first half of 2021 and the first half of 2022. Packaging is also not immune to price rises. There is an average increase of +9.3% since the beginning of 2022. Lastly, supply difficulties (e.g. sunflower oil for fried and breaded products), combined with costly logistical adjustments, have exacerbated the cost increase and weighed heavily on the profitability of the agri-food sector, with EBITDA falling by -16%, while that of the agricultural sector has risen by +12% as a result of the increase in selling prices.

This rise in prices has an impact on consumer behaviour. In 2022, 8 out of 10 French people have adapted to the inflationary context. This adaptation is reflected in an increase in sales of retailer brands – +0.7% in August 2022 compared to August 2021 – and a decrease in sales of organic products of -10.1% over the same period compared to the previous year. These trends, confirmed at the end of 2022, are expected to continue in 2023.

Protein price competition benefits poultry sector

2022 will be a year of raw material cost increases and a second year of avian flu in the poultry sector. The increase in the price of grain needed to feed poultry – due to the war in Ukraine – combined with a second outbreak of bird flu, which reduced the amount available, and the increase in the price of packaging, inevitably affected the industry’s selling price. Thus, despite a -3% drop in household consumption in 2022, poultry processors increased their turnover by 8% over the same year. The sector is also facing a labour shortage. In June 2022, 70% of the managers surveyed said they were facing a shortage of applicants and qualified staff.

Sources :

- Inflation in food prices

- Rising food prices

- State aid

- Behaviour of the French

- Gas and electricity prices

- Rising prices for poultry packaging

Review of mergers and acquisitions

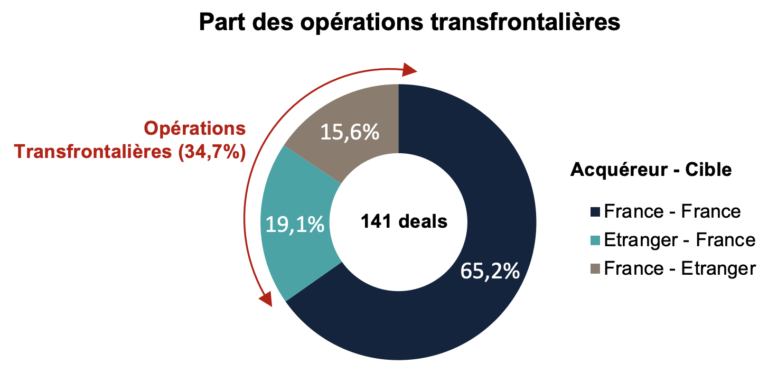

Auris Finance has identified 130 transactions in the agri-food sector in 2022 involving at least one French party (acquirer or target).

Of the 130 transactions identified, 19 were carried out by foreign buyers (the acquisition of BZ Groupe by the American Bunge, the acquisition of Louis François by the Swedish Novax or the sale of the Picon brand by the British Diageo group to the Italian Campari group), representing 15% of the total number of transactions.

French companies acquired 24 foreign companies in 2022, such as the Leduff group’s acquisition of the American company Lecoq cuisine, PAI Partners’ acquisition of a stake in the Austrian company Savory Solution and Sodiaal’s acquisition of a majority stake in Yoplait from General Mills. These transactions represent 18% of the transactions carried out during the year.

The remaining 87 transactions were all between French companies, such as the acquisition of Matines by the LDC group, the acquisition of Keranna Production, a subsidiary of the Agromousquetaires group, by Cité Marine, the sale of Pêcheurs de saveurs by the NICOT group to the Guyader Gastronomie group and the acquisition of Oberti by the Alliance group. AURIS Finance advised on the sale of these last three transactions.

Cross-border transactions (33%) Buyer – target

France – France

Foreign-France

France – Foreign

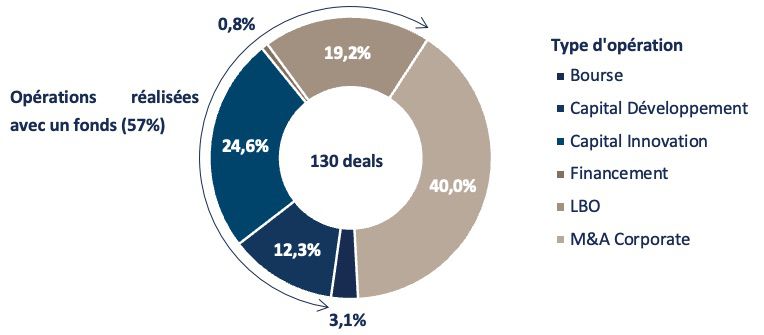

Of the 130 transactions, 62 involved at least one investment fund, representing 47% of the transactions. This proportion, which is higher than last year, demonstrates the continued interest of funds in the agri-food sector, even in a period of economic uncertainty.

with an investment fund (57%) Type of transaction

Stock Exchange

Growth Capital

Innovation Capital

Financing

LBO

M&A Corporate

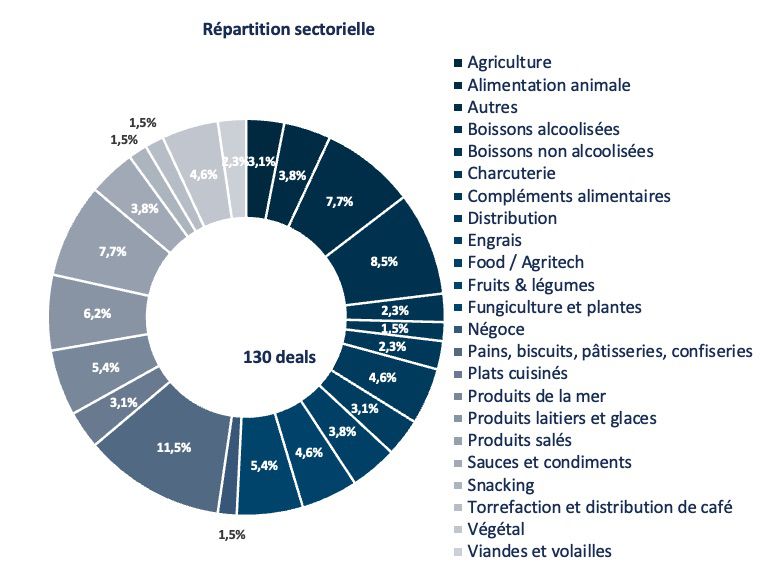

The most dynamic sectors are: bread, biscuits, pastries and confectionery (e.g. Groupe Gozoki – Sectal, Sagard’s investment in Novepan, etc.), which accounted for 11. 5% of the transactions carried out in this sector, followed by alcoholic beverages with 8.5% (e.g. Artemis domaines – Maisons et domaines Henriot, Famille Moitry – Château Climens…), then the savoury products sector with 7.7% (e.g. Olives et co – Ansolive, Artisan gourmet – Charpalor…)

In conclusion, AURIS Finance confirms four major trends:

- 2022 has seen the highest inflation rate since 1980 with an average inflation of +5.2%. This significant increase in prices has influenced consumer behaviour, as consumers have turned away from more expensive organic products in favour of cheaper products such as retailer brands.

- Despite a difficult context for the agri-food sector (war in Ukraine, energy crisis, etc.), the interest of investment funds in the sector is not diminishing and is confirmed with 24 more deals than in 2021.

- The alcoholic beverages sector remains one of the most dynamic. The wine sector is more active than ever, with 9 out of 11 alcoholic beverages deals including at least one wine-related transaction (81%).

- For the second year in a row, French poultry consumption has fallen (-3% in 2022). This decline, initially due to consumer awareness of the need for more responsible production, is now linked to a rise in prices. With the war in Ukraine affecting grain prices, the energy crisis and avian flu limiting production volumes, processors are passing on part of the price increase.

| Transaction date | Buyer | Target company | Description | Transaction type |

|---|---|---|---|---|

| 2022-12 | GROUPE CASINO | SMART GOOD THINGS | Boissons non alcoolisées | Bourse |

| 2022-12 | FRENCHFOOD CAPITAL (FFC)|UNEXO | DIFAGRI | Alimentation animale | LBO |

| 2022-12 | HIGH FLYERS CAPITAL (HFC)|VOLNEY DEVELOPPEMENT|MADE FOR ALL | ARCHIE | Sauces et condiments | Capital Innovation |

| 2022-12 | TURENNE GROUPE|SIPAREX|IDIA CAPITAL INVESTISSEMENT|BNP PARIBAS DÉVELOPPEMENT|SOCIÉTÉ FINANCIÈRE DU LANGUEDOC ROUSSILLON (SOFILARO)|CRÉDIT AGRICOLE RÉGIONS INVESTISSEMENT (CARVEST)|CRÉDIT AGRICOLE ALPES DÉVELOPPEMENT (C2AD)|MANAGER(S) | COMPTOIR RHODANIEN | Fruits & légumes | LBO |

| 2022-12 | PAI PARTNERS | SAVORY SOLUTIONS | Produits salés | LBO |

| 2022-12 | ERHARD PÂTISSIER GLACIER (GLACES ERHARD DEVELOPPEMENT) | BRETZEL BURGARD | Pains, biscuits, pâtisseries, confiseries | M&A Corporate |

| 2022-12 | BUSINESS ANGEL(S) | URBAN CUISINE | Food / Agritech | Capital Innovation |

| 2022-12 | ARTISAN GOURMET | CHARPALOR | Produits salés | M&A Corporate |

| 2022-12 | LACTALIS | DAIRY PARTNERS AMERICAS (DPA) | Produits laitiers et glaces | M&A Corporate |

| 2022-12 | GO CAPITAL | ALINOVA | Alimentation animale | Capital Innovation |

| 2022-12 | BUNGE | BZ GROUPE | Agriculture | M&A Corporate |

| 2022-11 | ASTERION|CAMÉLÉON INVEST|SATGANA|BPIFRANCE INVESTISSEMENT | YEASTY | Fungiculture et plantes | Capital Innovation |

| 2022-11 | VIF SYSTEMS | PRET A POUSSER | Fungiculture et plantes | M&A Corporate |

| 2022-11 | SIPAREX|LA BOUCHERIE RESTAURANT|BAUDINVEST|SALARIES | MAISON BECAM | Distribution | Capital Développement |

| 2022-11 | LAWRENCE WINE ESTATES (GAYLON LAWRENCE)|MUTUELLE ASSURANCES CORPS SANTE FRANCAIS (MACSF) | CHATEAU LASCOMBES | Boissons alcoolisées | M&A Corporate |

| 2022-10 | ARKEA CAPITAL|IDIA CAPITAL INVESTISSEMENT|NCI|QUADIA | POISCAILLE | Produits de la mer | Capital Innovation |

| 2022-10 | GROUPE BEL (F.B.S.A) | ZHEJIANG RENZHICHU HEALTH INDUSTRY | Snacking | M&A Corporate |

| 2022-10 | LDC | OVOTEAM | Autres | M&A Corporate |

| 2022-10 | EARLYBIRD VENTURE CAPITAL|HEARTCORE CAPITAL (EX SUNSTONE CAPITAL)|POINT NINE CAPITAL (POINT9)|AIR STREET CAPITAL|PARTECH PARTNERS|KEEN VENTURE PARTNERS|BUSINESS ANGEL(S)|EUTOPIA|OMNES CAPITAL VENTURE|THIA VENTURES|DISCOVERY VENTURES | GOURMEY | Viandes et volailles | Capital Innovation |

| 2022-10 | ARTEMIS DOMAINES | MAISONS ET DOMAINES HENRIOT | Boissons alcoolisées | M&A Corporate |

| 2022-10 | MANAGER(S)|AMDG PRIVATE EQUITY | NAUTILUS FOOD | Produits de la mer | LBO |

| 2022-10 | FNB PRIVATE EQUITY|TURENNE GROUPE|SWEN CAPITAL PARTNERS|MANAGER(S) | MOUSLINE | Plats cuisinés | LBO |

| 2022-09 | AVRIL|CREDIT MUTUEL ARKEA|GROUPAMA|IDIA CAPITAL INVESTISSEMENT|NATIXIS|ANAMSO|FNA (FEDERATION DU NEGOCE AGRICOLE)|FED NAT AGRICULT MULTIPLICATEUR SEMENCES (FNAMS)|FEDER NATION LEGUME SEC (FNLS)|GROUPEMENT TRANSFORMATEURS D’OLEAGINEUX METROPOLITAINS (GTOM)|TERRES UNIVIA | SOFIPROTÉOL | Autres | Capital Développement |

| 2022-09 | SUNFOOD HOLDING | SOFY’S & CO|CORDON BLANC|A TABLE.COM | Autres | M&A Corporate |

| 2022-09 | NEXTSTAGE AM|IDIA CAPITAL INVESTISSEMENT|SPARKLING PARTNERS|UNILIS AGTECH|CRÉDIT AGRICOLE BRIE PICARDIE | JAVELOT | Food / Agritech | Capital Innovation |

| 2022-09 | DEMETER|BUSINESS ANGEL(S)|VOL-V | OÉ FOR GOOD | Boissons alcoolisées | Capital Innovation |

| 2022-09 | ASTANOR VENTURES (GOOD HARVEST VENTURES MANAGEMENT)|PEAKBRIDGE PARTNERS|SEVENTURE PARTNERS|BIG IDEA VENTURES|GOOD STARTUP | STANDING OVATION | Produits laitiers et glaces | Capital Innovation |

| 2022-09 | ALBAREST PARTNERS|AXIO CAPITAL|PERSONNE(S) PHYSIQUE(S)|ACTIONNAIRES FAMILIAUX|GARIBALDI PARTICIPATIONS | SOPRAUVERGNE/DISTRIFRAIS | Pains, biscuits, pâtisseries, confiseries | LBO |

| 2022-09 | NOVAX | LOUIS FRANCOIS | Pains, biscuits, pâtisseries, confiseries | M&A Corporate |

| 2022-09 | FOODARA|BUSINESS ANGELS DES GRANDES ÉCOLES (BADGE)|BUSINESS ANGEL(S) | CARRELEON | Fruits & légumes | Capital Innovation |

| 2022-08 | SAGARD | NOVEPAN | Pains, biscuits, pâtisseries, confiseries | LBO |

| 2022-09 | INVIVO RETAIL | BOULANGERIE LOUISE | Distribution | M&A Corporate |

| 2022-08 | VOL-V | MYCEA | Fungiculture et plantes | Capital Innovation |

| 2022-09 | SAIPOL | CENTRE GRAINS | Agriculture | M&A Corporate |

| 2022-07 | SEVENTURE PARTNERS|CRÉDIT AGRICOLE ALPES DÉVELOPPEMENT (C2AD)|INVESTISSEURS HISTORIQUES | BAOUW | Snacking | Capital Innovation |

| 2022-08 | COFEPP (LA MARTINIQUAISE – BARDINET) | MARIE BRIZARD WINE & SPIRITS | Boissons alcoolisées | Bourse |

| 2022-07 | FRENCHFOOD CAPITAL (FFC)|MANAGER(S) | CHAPON | Pains, biscuits, pâtisseries, confiseries | LBO |

| 2022-08 | GROUPE BEL (F.B.S.A) | SHANDONG JUNJUN CHEESE | Produits laitiers et glaces | M&A Corporate |

| 2022-07 | GROUPE SEB | ZUMMO | Food / Agritech | M&A Corporate |

| 2022-07 | BUSINESS ANGEL(S) | NEPTUNE ELEMENTS | Produits de la mer | Capital Innovation |

| 2022-07 | FAMILY OFFICES|KIMA VENTURES|BUSINESS ANGEL(S) | CHAMPAGNE EPC | Boissons alcoolisées | Capital Innovation |

| 2022-07 | GROUPE LE DUFF | LECOQ CUISINE | Pains, biscuits, pâtisseries, confiseries | M&A Corporate |

| 2022-07 | GUYADER GASTRONOMIE | PECHEUR DE SAVEURS | Plats cuisinés | M&A Corporate |

| 2022-07 | STRIDE.VC|PROJECT A VENTURES | HORS NORMES | Végétal | Capital Innovation |

| 2022-07 | WATERLAND PRIVATE EQUITY|SODIAAL|MANAGER(S)|ACTIONNAIRES FAMILIAUX | BONCOLAC|MAG’M | Pains, biscuits, pâtisseries, confiseries | LBO |

| 2022-07 | GROUPE CASTEL|SOCIETE ANONYME DES BRASSERIES DU CAMEROUN (SABC) | GUINNESS-CAMEROUN (GCSA) | Boissons alcoolisées | M&A Corporate |

| 2022-07 | NAXICAP PARTNERS|MOUVEMENT & FINANCE (MTF – MT FINANCE SA)|BUSINESS ANGEL(S) | ATELIER NUBIO | Boissons non alcoolisées | Capital Innovation |

| 2022-07 | JACOBS DOUWE EGBERTS (JDE) | LES 2 MARMOTTES | Fungiculture et plantes | M&A Corporate |

| 2022-07 | MIROVA | ATLAS FRUITS COMPANY | Fruits & légumes | Capital Développement |

| 2022-07 | GROUPE CHEVRILLON|CRÉDIT AGRICOLE RÉGIONS INVESTISSEMENT (CARVEST) | GROUPE ARCADO | Viandes et volailles | LBO |

| 2022-07 | Geoffroy Houette, Damien Douillet, François-Xavier Douillet | ETABLISSEMENTS WERSCHUREN | Négoce | M&A Corporate |

| 2022-06 | CREDIT MUTUEL EQUITY|MANAGER(S) | FRENCH DESSERTS | Pains, biscuits, pâtisseries, confiseries | Capital Développement |

| 2022-06 | BIG IDEA VENTURES|TECHMIND|BEAST VENTURES|VEG CAPITAL|TRELLIS ROAD|FOODHACK | NUTROPY | Produits laitiers et glaces | Capital Innovation |

| 2022-07 | OLIVES & CO | ANSOLIVE | Produits salés | M&A Corporate |

| 2022-06 | AMBROSIA INVESTMENTS|GO CAPITAL|BUSINESS ANGEL(S) | PEPETTE | Alimentation animale | Capital Innovation |

| 2022-07 | LDC | MATINES | Viandes et volailles | M&A Corporate |

| 2022-07 | GROUPE EVEN | SOFRAMA HOLDING | Distribution | M&A Corporate |

| 2022-07 | CITE MARINE | KERANNA PRODUCTIONS | Végétal | M&A Corporate |

| 2022-06 | INVUS|BUSINESS ANGEL(S) | HAPPYVORE (EX LES NOUVEAUX FERMIERS) | Végétal | Capital Innovation |

| 2022-06 | CAPITOLE ANGELS|PROVENCE ANGELS|OCSEED | HOOPE | Pains, biscuits, pâtisseries, confiseries | Capital Innovation |

| 2022-06 | Famille Moitry | CHÂTEAU CLIMENS | Boissons alcoolisées | M&A Corporate |

| 2022-06 | CHATEAU CHEVAL BLANC | LA TOUR DU PIN | Boissons alcoolisées | M&A Corporate |

| 2022-06 | Ghislain Lesaffre | LEROUX | Végétal | M&A Corporate |

| 2022-05 | BPIFRANCE INVESTISSEMENT|CRÉDIT AGRICOLE RÉGIONS INVESTISSEMENT (CARVEST) | CHEVENET | Produits laitiers et glaces | Capital Développement |

| 2022-06 | DISLOG GROUP (H&S INVEST HOLDING) | CULTURES DE FRANCE | Produits salés | M&A Corporate |

| 2022-05 | PERSONNE(S) PHYSIQUE(S)|FRENCHFOOD CAPITAL (FFC)|ARKEA CAPITAL | ROLMER | Produits de la mer | LBO |

| 2022-05 | DEMETER|SENSEII VENTURES|FOUNDERS FUTURE|BEYOND IMPACT | SEAFOOD REBOOT | Produits de la mer | Capital Innovation |

| 2022-04 | EDIFY (EX SOMFY PARTICIPATIONS) | AGROMILLORA | Végétal | Capital Développement |

| 2022-04 | EVERGREEN GARDEN CARE | AQUILAND | Autres | M&A Corporate |

| 2022-04 | ASTANOR VENTURES (GOOD HARVEST VENTURES MANAGEMENT)|XANGE|BLUE HORIZON VENTURES|NUCLEUS CAPITAL | PLANETARY | Food / Agritech | Capital Innovation |

| 2022-04 | BUSINESS ANGEL(S) | REGLO | Alimentation animale | Capital Innovation |

| 2022-06 | VALENTIN TRAITEUR | ROLAND MONTERRAT | Produits salés | M&A Corporate |

| 2022-05 | Valérie Chiron, Janet Mandard, Emmanuel Le Goff | MAX VAUCHÉ | Produits laitiers et glaces | M&A Corporate |

| 2022-03 | SOFIPROTÉOL|UNIGRAINS | TERRES DU SUD | Distribution | Capital Développement |

| 2022-05 | FONDS DE SOLIDARITÉ FTQ|CAISSE DE DEPOT ET PLACEMENT DU QUEBEC (CDPQ) | BONDUELLE AMERICAS LONG LIFE (BALL) | Fruits & légumes | M&A Corporate |

| 2022-05 | COMPAGNIE LÉA NATURE (LÉA NATURE, BIOLÉA, EKIBIO) | ALPES BISCUITS (BIO SOLEIL) | Pains, biscuits, pâtisseries, confiseries | M&A Corporate |

| 2022-03 | SOFIPROTÉOL|UNIGRAINS|MULTICROISSANCE|BNP PARIBAS DÉVELOPPEMENT | DE SANGOSSE | Engrais | Capital Développement |

| 2022-05 | CAMPARI | PICON | Boissons alcoolisées | M&A Corporate |

| 2022-03 | ASTER DÉVELOPPEMENT (ALPINA SAVOIE ET MOULINS DE SAVOIE) | HEIMBURGER (PÂTES GRAND’MÈRE) | Produits salés | LBO |

| 2022-04 | AGROMOUSQUETAIRES | SAINT MAMET | Fruits & légumes | M&A Corporate |

| 2022-03 | WAVE EQUITY PARTNERS|EIC FUND|LIBERSET|PREMICE-INCUBATEUR DE BOURGOGNE | NOVOLYZE | Autres | Capital Innovation |

| 2022-03 | FAMILY OFFICES|MANAGER(S) | BASERRIA (MAISON LARTIGUE & FILS) | Plats cuisinés | LBO |

| 2022-04 | DEWAVRIN | EFFINOV NUTRITION | Compléments alimentaires | M&A Corporate |

| 2022-04 | CHÂTEAU SANSONNET | CHÂTEAU VILLEMAURINE | Agriculture | M&A Corporate |

| 2022-03 | AFI VENTURES|PICUS CAPITAL|HIGH FLYERS CAPITAL (HFC)|FOUNDERS FUTURE|KIMA VENTURES|NOTUS TECHNOLOGIES|BUSINESS ANGEL(S) | BON VIVANT | Produits laitiers et glaces | Capital Innovation |

| 2022-04 | GROUPE ALLIANCE | BERNI | Charcuterie | M&A Corporate |

| 2022-03 | ASTANOR VENTURES (GOOD HARVEST VENTURES MANAGEMENT)|REDALPINE VENTURE PARTNERS|FRENCH PARTNERS|VERSO FUND|NEWFUND|BPIFRANCE INVESTISSEMENT | UMIAMI | Végétal | Capital Innovation |

| 2022-03 | MERIDIAM|BOURRELIER GROUP (EX BRICORAMA)|CÉLESTE MANAGEMENT|BUSINESS ANGEL(S) | POPCHEF | Food / Agritech | Capital Innovation |

| 2022-02 | HIGH FLYERS CAPITAL (HFC)|BUSINESS ANGEL(S) | NÄAK | Compléments alimentaires | Capital Innovation |

| 2022-02 | TURENNE GROUPE | VINS+VINS | Négoce | Capital Développement |

| 2022-02 | TURENNE GROUPE|MANAGER(S)|FONDATEUR(S) | PHODE | Alimentation animale | LBO |

| 2022-02 | BUSINESS ANGEL(S)|TIPASA PARTNERS | FRENCH BLOOM | Boissons non alcoolisées | Capital Innovation |

| 2022-01 | Banques | CRISTAL UNION | Autres | Financement |

| 2022-03 | HERMIONE PEOPLE & BRANDS|FINANCIÈRE IMMOBILIÈRE BORDELAISE (FIB) | CAFES LEGAL | Torrefaction et distribution de café | M&A Corporate |

| 2022-03 | TERRIAL | AMENDIS | Engrais | M&A Corporate |

| 2022-03 | GROUPE ANAQEON (QUERCEO-B’OAK) | DAIR NUA COOPERAGE | Autres | M&A Corporate |

| 2022-03 | AVRIL | ECCELLENZA ITALIANA | Produits salés | M&A Corporate |

| 2022-01 | BDR INVEST (BDR IT)|CRÉDIT AGRICOLE RÉGIONS INVESTISSEMENT (CARVEST)|PERSONNE(S) PHYSIQUE(S) | BOURGOGNE ESCARGOTS | Produits salés | LBO |

| 2022-01 | BPIFRANCE INVESTISSEMENT|CREDIT MUTUEL EQUITY | GRAIN DE SAIL | Torrefaction et distribution de café | Capital Développement |

| 2022-01 | LITTO INVEST|LE GOUESSANT|BAMBOO | LISAQUA | Produits de la mer | Capital Innovation |

| 2022-03 | PERNOD RICARD | CHÂTEAU SAINTE MARGUERITE | Agriculture | M&A Corporate |

| 2022-03 | DISLOG GROUP (H&S INVEST HOLDING) | CARRE SUISSE | Pains, biscuits, pâtisseries, confiseries | M&A Corporate |

| 2022-01 | SIPAREX | RHONE ISLAND (CHARCUTERIE MAS ET MIQUEL) | Plats cuisinés | Capital Développement |

| 2022-02 | GROUPE ALLIANCE | OBERTI | Charcuterie | M&A Corporate |

| 2022-02 | TIMAC AGRO | TIMAC AGRO KENYA (EX CFAO AGRI KENYA) | Engrais | M&A Corporate |

| 2022-02 | CITRI&CO | ARCO FRUITS | Fruits & légumes | M&A Corporate |

| 2022-02 | INVESTISSEURS INSTITUTIONNELS – LP’S | GRAINES VOLTZ | Autres | Bourse |

| 2022-02 | GRAINES VOLTZ | ANDRE BRIANT JEUNES PLANTS (ABJP) | Autres | M&A Corporate |

| 2022-09 | L CATTERTON|VORWERK VENTURES|TENGELMANN VENTURES|GULLSPANG REFOOD|BE8 VENTURES|ETH ZURICH FOUNDATION|ACE & COMPANY|BUSINESS ANGEL(S) | PLANTED FOODS | Produits salés | Capital Innovation |

| 2022-02 | BIOBEST | PLANT PRODUCTS | Engrais | M&A Corporate |

| 2022-05 | HOLTZBRINCK VENTURES (HV CAPITAL)|FIVE SEASONS VENTURES|PARTECH PARTNERS | KORO | Produits salés | Capital Innovation |

| 2022-07 | L CATTERTON | LITTLE MOONS | Produits laitiers et glaces | Capital Développement |

| 2022-02 | ASSOCIATED BRITISH FOODS (ABF)|ABF INGREDIENTS | FYTEXIA | Compléments alimentaires | Bourse |

| 2022-02 | FAMILLE PIFFAUT VINS & DOMAINES (FPVD) | GABRIEL BOUDIER | Boissons alcoolisées | M&A Corporate |

| 2022-07 | SOFINA|MERIEUX EQUITY PARTNERS|INVESTISSEUR(S) PRIVÉ(S) | BIOBEST | Fungiculture et plantes | Capital Développement |

| 2022-07 | SOFINA | BIOBEST | Fungiculture et plantes | Capital Développement |

| 2022-10 | SOLINA GROUP | SARATOGA FOOD SPECIALITIES | Sauces et condiments | LBO |

| 2022-09 | UNIGRAINS | HUILERIE CAUVIN | Sauces et condiments | Capital Développement |

| 2022-07 | BOULANGERIES SOPHIE LEBREUILLY | EMILE BEC | Distribution | LBO |

| 2022-01 | RIGONI DI ASIAGO | SAVEURS & NATURE | Pains, biscuits, pâtisseries, confiseries | M&A Corporate |

| 2022-07 | MOREL DIFFUSION | SAS OTTENWAELDER FRERES (AZUR PLANTES) | Fungiculture et plantes | LBO |

| 2022-06 | EUROGERM | EUROGERM KB LLC (EX KB INGREDIENTS ET EUROGERM USA) | Pains, biscuits, pâtisseries, confiseries | LBO |

| 2022-01 | GROUPE GOZOKI | SECTAL | Pains, biscuits, pâtisseries, confiseries | M&A Corporate |

| 2022-06 | SOLINA GROUP | ZAFRON FOODS | Sauces et condiments | LBO |

| 2022-04 | SOLINA GROUP | SAUCES ET CREATIONS|ATELIER D2I | Sauces et condiments | LBO |

| 2022-03 | BOULANGERIES SOPHIE LEBREUILLY | BOULANGERIES FRED (ALERE) | Distribution | LBO |

| 2022-02 | ICONIC NECTARS (EX RENAUD COINTREAU)|INVESTISSEUR(S) PRIVÉ(S) | LE BARTELEUR (ALCOOV) | Boissons alcoolisées | Capital Développement |

| 2022-01 | PROSOL GESTION (GRAND FRAIS)|ARDIAN | GROUPE OCEALLIANCE (EX MARITEAM) | Produits de la mer | LBO |

| 2022-01 | COMPAGNIE DES DESSERTS | GROUPE PHILIPPE FAUR | Pains, biscuits, pâtisseries, confiseries | LBO |

| 2022-01 | NUTRISENS | LABORATOIRES SANTINOV | Autres | LBO |