Despite the challenges of 2023, such as rising interest rates, inflation, and a decrease in temporary employment, the Human Resources sector stood out for its strong pace in mergers and acquisitions.

Against this backdrop, the number of transactions recorded was larger than in 2022, with our 2023 report showing 31 transactions in this sector, up from 26 the previous year.

This trend has spread to all market segments, including temporary work, recruitment consultancy, umbrella companies, interim management and HR consultancy, as well as traditional and digital operators.

AURIS Finance, working with a number of companies in the sector, has analysed the various acquisition strategies that stood out in 2023:

- Strategy of network densification: PARTNAIRE’s acquisition of ID SEARCH is a perfect illustration of this approach, signalling an increase in its agency network, particularly in Paris and Lyon. This strategic expansion aims to strengthen PARTNAIRE’s presence in key geographical areas.

- Diversification into new sectors: AKSIS MOOVEUS, a training company, has been acquired by PROMAN, a prominent player in the temporary employment industry. This strategic operation enables PROMAN to broaden its sourcing and activity beyond its traditional core business.

- Targeted positioning in niche markets: The acquisition of ASCENSO, a company that specialises in staff delegation in the mountain tourism sector, is part of DOMINO’s objective to diversify its activities and strengthen its presence in high-potential industries.

- Ongoing digital transformation: The LIP group’s acquisition of OMEDO demonstrates the importance of further digital transformation for sector players in order to respond effectively to current market demands.

- International expansion: The acquisition of TECHVISIE by the TRIANGLE group demonstrates the determination of companies who have reached critical mass in France to assist their clients while expanding their sourcing beyond national borders.

| Transaction date | Buyer Founder | Target company | Transaction type | Target turnover | Target activity |

|---|---|---|---|---|---|

| déc.-23 | ANDREA PARTNERS | MISTERTEMP | Levée de fonds | 420 | Intérim « phygital » |

| déc.-23 | BNP | STAFFMATCH | Levée de fonds | - | Intérim « phygital » |

| déc.-23 | PARTNAIRE | GROUPE ID SEARCH | Acquisition | 15 | Recrutement / Travail temporaire / Management de transition |

| déc.-23 | DOMINO | ASCENSO | Acquisition | 2 | Conseil RH / Recrutement |

| déc.-23 | ACTRIUM | KER INTERIM | Acquisition | 2 | Travail Temporaire |

| nov.-23 | INITIATIVE & FINANCE | RÉSEAU VERT L'OBJECTIF | Levée de fonds | 33 | Travail Temporaire |

| oct.-23 | NC (BUSINESS ANGELS) | GOODRECRUITER | Levée de fonds | - | Recrutement |

| sept.-23 | MENWAY | MA BONNE FEE | Acquisition | - | Conseil RH |

| sept.-23 | UI INVESTISSEMENT | FAB GROUP | Levée de fonds | - | Recrutement / Transition / Travail temporaire |

| sept.-23 | ABBERLINE | JOB4 | Acquisition | - | Recrutement |

| sept.-23 | PROMAN | IZIWORK | Acquisition | 250 | Intérim digital |

| août-23 | FREELANCE.COM (100%) | OPENWORK (LE MONDE APRES) | Acquisition | 70 | Portage salarial |

| août-23 | ACTUAL | ALFALIMA RH | Acquisition | 1 | Recrutement |

| août-23 | PREMIER ETAGE / SODERO GESTION | GRIMP | Levée de fonds | - | Recrutement digital, insertion |

| juil.-23 | ACTUAL | CLEMENTINE | Acquisition | 2.2 | Recrutement |

| juil.-23 | LIP | OMEDO | Acquisition | 13 | Intérim digital |

| juin-23 | ALIXIO | X-PM | Acquisition | 26.5 | Management de transition |

| mai-23 | OASYS | ALERYS | Acquisition | 30 | Conseil RH |

| mai-23 | ACTUAL | KOBALTT | Acquisition | 15.5 | Recrutement /Management de transition |

| avril-23 | PROMAN | PEOPLESHARE (USA) | Acquisition | 146 | Travail Temporaire |

| avril-23 | LINCOLN | SHAPR TALENT | Acquisition | - | Recrutement |

| avril-23 | TRIANGLE SOLUTIONS RH | TECHVISIE (NL) | Acquisition | 17 | Travail Temporaire |

| mars-23 | MML CAPITAL PARTNERS /BPI | FREELAND GROUP | Levée de fonds | 420 | Plateforme de freelancing et portage |

| mars-23 | ASAP WORK | SPEED INVEST/KIMA VENTURES/MOC/PURPLE | Levée de fonds | - | Travail Temporaire |

| mars-23 | PROMAN | AKSIS MOOVEUS | Acquisition | 70 | Formation (retour à l'emploi) |

| févr.-23 | IMPACT PARTNERS | ALTERNEGO | Levée de fonds | 7.5 | Conseil dont RH |

| févr.-23 | BALDERTON / WENDEL / SERENA CAPITAL | BRIGAD | Levée de fonds | - | Intérim digital |

| janv.-23 | NETWORK | ADISPO | Acquisition | 9 | Travail Temporaire |

| janv.-23 | ANYWR | SOLANTIS | Acquisition | 9 | Recrutement |

| janv.-23 | LINCOLN | THE EXECUTIVE NETWORK (NL) | Acquisition | 9 | Recrutement |

| janv.-23 | VNCA | ADH | Acquisition | 4.5 | Conseil RH |

The growing number of fundraisings, especially by digital companies, is driving the increase in transactions.

As a case in point, BRIGAD raised €33 million to continue developing its tools and step up its growth on a European scale.

Also in the temporary employment market, ANDREA MID CAP’s acquisition of a majority LBO marks a new phase in MISTERTEMP’s development. The transaction will enable the group to develop its existing agency network in France and Italy, expand internationally in Germany and Spain, and strengthen its digital platform. Taken together, these steps will enable the group to achieve a turnover of €1 billion by 2028.

On another front, FREELAND, the freelance platform with a turnover of over €400 million, has successfully completed its second LBO. This transaction will enable the company to further develop its technology platform with the aim of becoming a major player in the European recruitment market by 2027.

Focus on the temporary work sector in 2023

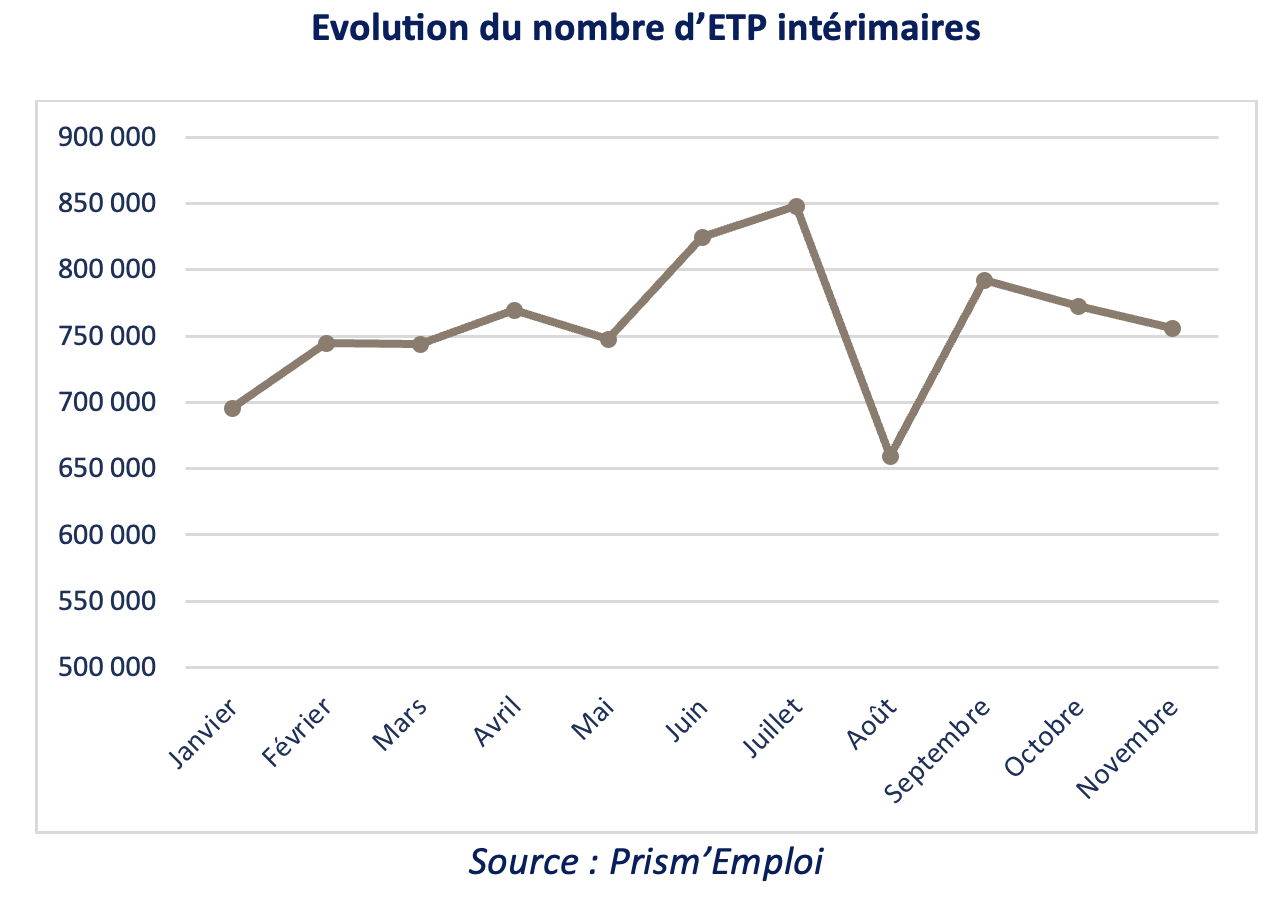

After a sustained level of activity in 2022 (5% growth in temporary employment compared to 2021), the sector was hit by a worsening economic context in 2023, with a 4% fall in the number of temporary workers. However, the turnover of temporary employment agencies has increased by 6%, a trend directly linked to inflation in the salaries of re-invoiced temporary workers.

All temporary employment sectors show a downward trend in 2023. This is particularly the case in industry, with a year-on-year drop of -8.1%, reaching its lowest point at the end of 2023. The tertiary sector has also seen a decline of -7.4%. With a fall of 3.3%, the construction and civil engineering sector fared best, remaining above average.

Change in the number of temporary FTEs

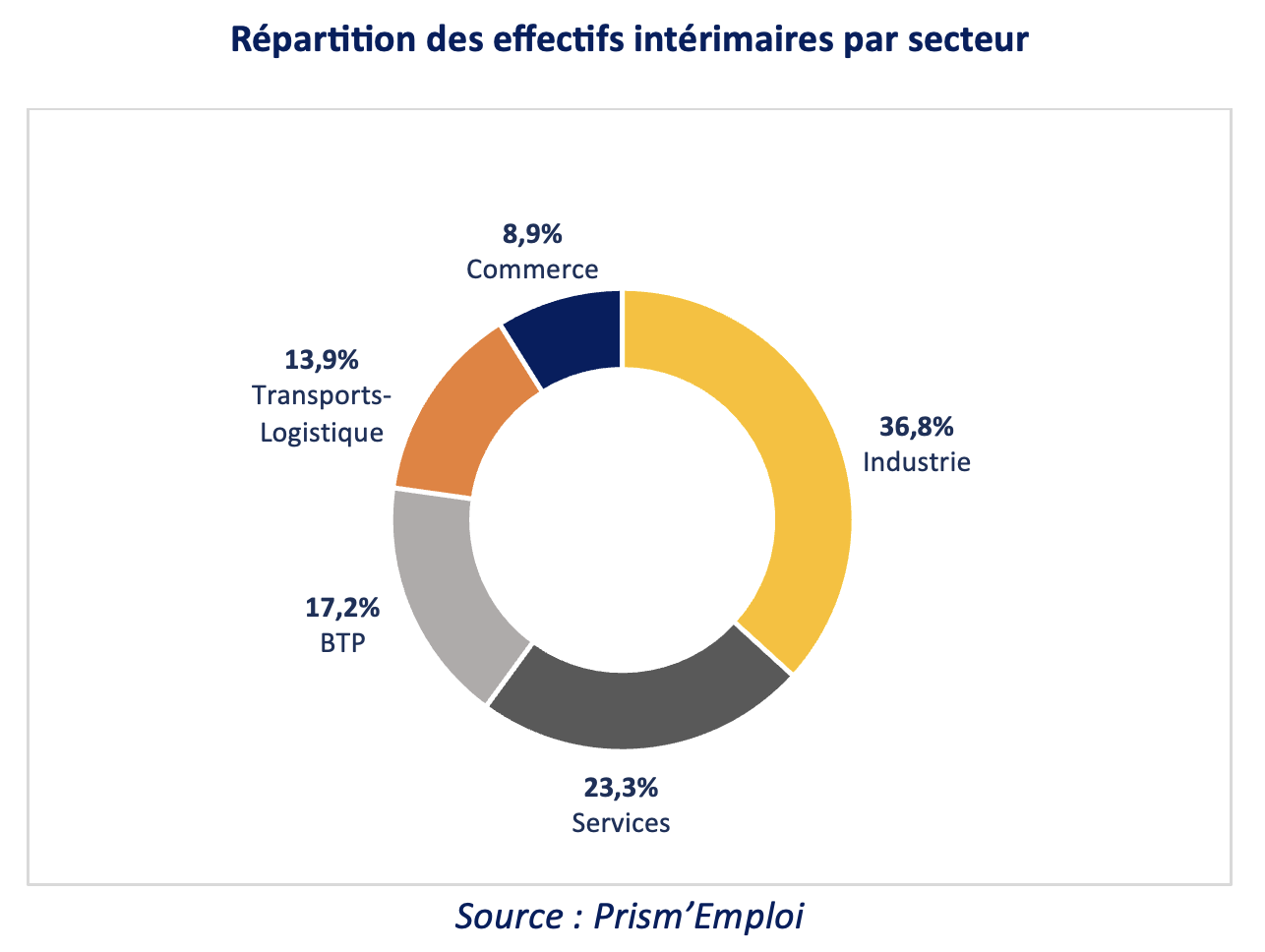

Breakdown of temporary staff by sector

The majority of companies using temp workers are in industry (36.8%), services (23.3%) and construction (17.2%). It should be noted, however, that over the last twenty years the share in industry has been declining to the benefit of the other sectors.

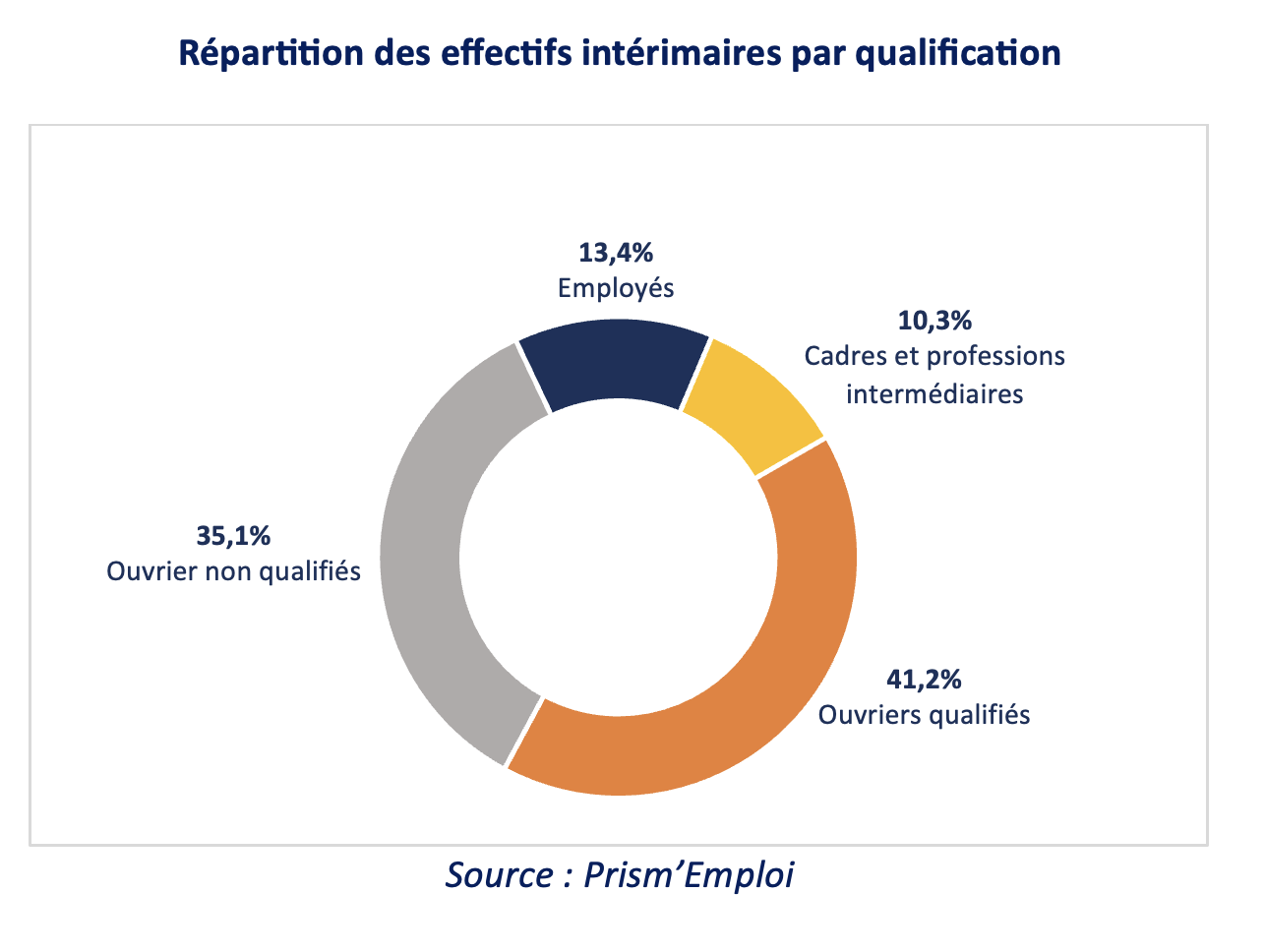

Breakdown of temporary staff by type of qualification

A similar trend can be seen among temporary workers. More than 75% of temporary workers are blue-collar workers (41.2% of whom are skilled), while white collar and managerial staff now account for 23.7% of the total.

Over the past year, temporary employment has fallen in most regions. In particular, there was a drop of -8.6% in Auvergne-Rhône-Alpes (corresponding to a decrease of 9,800 temporary workers), -4.6% in Île-de-France (i.e. -6,100) and -7.2% in Grand Est (i.e. -5,000).

Key trends in the sector

Changes in temporary employment companies

The temporary employment sector in France has undergone significant changes in recent years. The three main players, ADECCO, MANPOWER, and RANDSTAD, which strongly dominated the French market ten years ago, are gradually losing their influence. At the same time, notable competitors are emerging, bringing the market closer to equilibrium.

In addition to these three major groups, around a dozen other temporary employment companies have emerged and experienced significant growth, thanks in particular to various acquisitions. These include ACTUAL and PROMAN, which were involved in 6 acquisitions in 2023.

Temp employment companies are diversifying their activities

Temporary employment agencies are expanding beyond their core business to become “one-stop shops” for all of a company’s human resources needs. They are also focusing on human resources consulting. Companies can use this strategy to decrease their susceptibility to economic swings while also creating new revenue streams.

Temporary employment in the digital age

The temporary staffing sector is continuing its digital transformation, which began several years ago with the emergence of digital temporary work specialists such as GOJOB and STAFFMATCH, offering services with lower rates and greater responsiveness. This trend is being reinforced by the increasing involvement of industry leaders in digital businesses. This dynamic has led to a number of transactions in the digital sector in 2023, such as the merger between PROMAN and IZIWORK or LIP and OMEDO.

The aim is to improve the efficiency of agencies and offer seamless client/employee processes through dematerialisation and automation, while maintaining the human aspect in application selection.

The Human Resources consulting market

In 2023, the HR consulting market faced a number of major challenges, resulting from both the need for companies to recruit qualified staff to cope with a rapidly changing economic and technological context, and a shortage of candidates. The growing expertise and specialisation of HR consultancies in specific business sectors has been a key factor, enabling them to understand companies’ needs and respond effectively to new issues and challenges.

Companies have had to adapt to a hybrid working environment, combining remote working with physical presence, and this has led to changes in recruitment and talent management strategies. The digitalisation of recruitment processes has accelerated, with increased use of online platforms, but also the use of new technologies, such as artificial intelligence, in the recruitment process.

Faced with an increasingly complex environment, companies still have an existential need to recruit new staff. To meet this competition, they have implemented various strategies to attract new talent, including sourcing. Social networks have become the second most used recruitment channel, just behind job advertisements.

Inorganic growth is also one of the strategies adopted by HR and recruitment consultancies. This is the case of the ABBERLINE group with JOB4 and that of ANYWR with SOLANTIS.

Forecasts for 2024

Despite the inversion of the yield curve and the expectation of a decline in activity, M&A activity in the HR sector should remain at a satisfactory level in 2024. The continuity of transfers already underway and the need for private equity funds to invest their cash suggest that the volume of transactions will be similar to that seen in 2023.

(Sources: Dares, Prism’Emploi, projections XERFI)

Get the support you need

Thanks to their sector expertise, AURIS Finance’s experts can assist you with all your M&A operations.