After a rather exceptional year for mergers and acquisitions in 2021, 2022 marked a downturn. Indeed, the volume of transactions fell by 40% worldwide and by 39% in France. However, compared to pre-sanitary crisis levels, the volume of transactions is down by 8% globally and by 9.3% in France.

In this context, the human resources sector, although slightly contracting, remained at a sustainable level in France in 2022. Our 2021 report recorded 30 transactions in this sector, compared to 26 transactions in 2022. All market segments are affected: temporary work, recruitment consultancy, interim management, HR consultancy, traditional and digital providers.

Less volume but similar types of transactions. The appetite for investment (external growth, acquisition of majority stakes or fundraising) is still there, whether for the sector’s majors or for small and medium-sized companies. The relative decline in the number of transactions is largely due to the rise in inflation and the consequent increase in interest rates, which have cut off the supply of low-interest money. However, this decline has been offset by the need for large groups to offer their clients greater geographical coverage (horizontal integration) and/or the ability to support them with a wider range of HR services (global staffing offer).

2022 was notable for two very important transactions: the acquisition of Timing (Netherlands) by Proman, and the acquisition of Ergalis by Actual Leader Group. The major players in the sector have also been involved in the acquisition of numerous companies. These include Manpower, Adequat and House of HR. Finally, two start-ups raised funds, the same number as in 2021: Anywr (€80 million) and Gojob (€23 million).

AURIS Finance has supported more companies in the sector this year than in 2021, despite tougher conditions. AURIS Finance confirms its position as leader in M&A in the HR sector with around ten transactions in 2022.

| Buyer/investor | Country | Target | Type of transaction |

|---|---|---|---|

| GROUPE SOFT | France | ACE INGENIERIE | M&A |

| INGEROP | France | ACTERRA | M&A |

| PLASTIC OMNIUM | France | ACTIA POWER | M&A |

| ACCENTURE | Irlande | AFD.TECH | M&A |

| EGIS | France | AG CONCEPT | M&A |

| ALTER EGO | France | AIR TRAITEMENT PROCESS | M&A |

| MANAGEMENT | France | ALTEREO | LBO |

| INTECH GROUP | France | ART INDUSTRIE | M&A |

| ALTYN GROUP | France | AVELTYS | M&A |

| SODERO GESTION | France | AZ METAL | Levée de fonds |

| ALBEDO | France | BESB | M&A |

| BAM | France | BRIT’ALU | M&A |

| BLUE PEARL ENERGY | France | BST | M&A |

| B-HIVE | France | BTM CONSULTANTS | M&A |

| ORANO | France | CERIS GROUP | M&A |

| SAFRAN MBDA | France | CILAS | M&A |

| BLUE PEARL ENERGY | France | CLIMACOOL | M&A |

| CAP INGELEC | France | CONCEPTUEL | M&A |

| SOLUTECH | France | CONPAS INNOVATIVE | M&A |

| AVENIR TELECOM / QUEYRAS | France | CORZY AIR | Levée de fonds |

| BLUE PEARL ENERGY | France | ECCI-DURBIANO | M&A |

| VULCAIN ENGINEERING | France | EFINOR (PÔLE AMÉNAGEMENT NAVAL) | M&A |

| TIKEHAU CAPITAL / CAISSE DES DÉPÔTS | France | EGIS | Levée de fonds |

| ALTRAD | France | ENDEL | M&A |

| ISATIS CAPITAL | France | ENERTION | LBO |

| GINGER | France | ENVIRONNEMENT – INVESTIGATIONS | M&A |

| FAMILLE HERTEAU | France | EXITIS | M&A |

| BLUE PEARL ENERGY | Belgique/France | FCT | M&A |

| CAPITAL EXPORT | France | FOGALE SENSORS | LBO |

| GINGER | France | FUGRO FRANCE DIVISION LSC | M&A |

| COBEPA | Belgique | GROUPE CLIMATER | LBO |

| TURENNE EMERGENCE | France | INAXE | LBO |

| ORANO | France | INEVO | M&A |

| CAP INGELEC | France | INGENOVA | M&A |

| ABL GROUP | Royaume-Uni | INNOSEA | M&A |

| DELTA ENGINEERING | France | ISYTECH | M&A |

| BAELEN | France | MACHINE DUBUIT | M&A |

| DOLFINES | France | MAINTCONTROL | M&A |

| INSTALLUX | France | MÉCANALU | M&A |

| PHOTOSOL | France | MOBEXI | M&A |

| TURENNE GROUPE / MANAGERS | France | OCELLIS | LBO |

| BETEM | France | OPTIMETRIE | M&A |

| ASSYSTEM | France | OREKA INGÉNIERIE | M&A |

| GROUPE KALI | France | PHRYSE | M&A |

| PACEO | France | QUELET COMPOSITES & SOLUTIONS | M&A |

| GESTAL | France | RCT INDUSTRIE | M&A |

| DEMETER / KREAXI / HAND PARTNERS / VENTECH | France | REVCOO | Levée de fonds |

| SILEANE | France | ROBAUT CONCEPTION | M&A |

| ALPHI | France | SIMPRA | M&A |

| OCTOPUS BIOSAFETY | France | TIBOT | M&A |

| ORINOX | France | URBICA | M&A |

| WEINBERG CAPITAL | France | VERTICAL SEA | LBO |

| GROUPE GUITON | France | VISA INGENIERIE | M&A |

Focus on temporary work in 2022

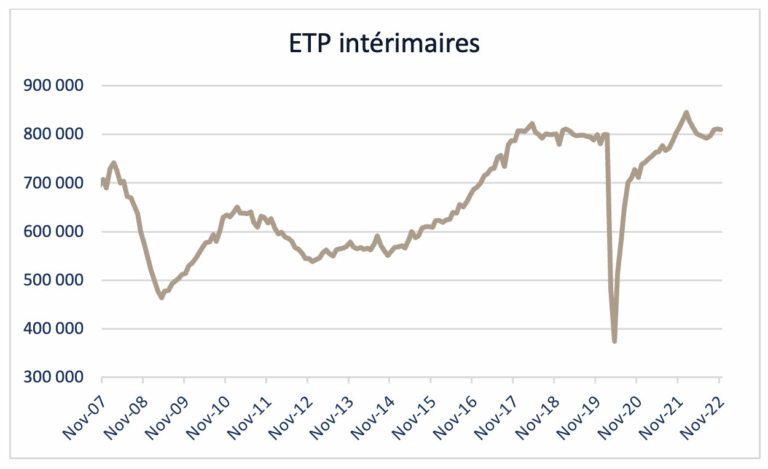

The temporary employment market continued its momentum in 2021, albeit with a slight correction. Indeed, its strong growth enabled it to reach 865,000 FTEs in January 2022, an all-time record. The end of the health crisis, which allowed good economic momentum, contributed to this upward trend. The Omicron wave also benefited the sector, as it led to a lot of sick leave and thus made room for many staff replacements. However, this trend weakened in the course of 2022, with the number of temporary workers falling at the end of the year. At the end of November, the number of FTEs was estimated at 809,400. For comparison, this level of FTEs is in line with the pre-crisis period of 2017-2019.

Successive revaluations of the French minimum wage have led to an increase in the wages of temporary workers. This increase has had an upward impact on the billing rates of temporary agencies. This fact partly explains the increase in the sector’s turnover, which shows an increase of 10.5% in 2022.

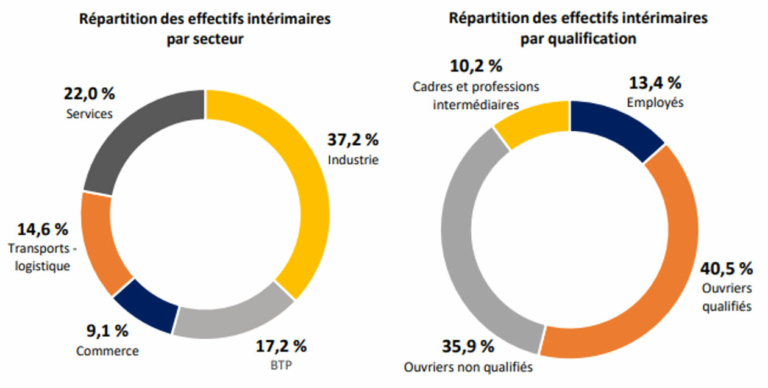

Compared with 2021, the number of FTEs at the end of 2022 increases by 1.7%. Trends vary by sector. Over one year, transport-logistics and construction and public works are down by 4.1% and 4.2% respectively. The trade sector is stagnating, with a change of 0.1% in FTE over one year. The hospitality sector grew by 2.4% over the year. However, the normalisation of the demand for temporary workers in this sector tends to reduce this growth. Finally, industry is the most dynamic sector, with an increase of 5.5% in FTE over one year. This result is mainly due to the dynamism of the automobile and aeronautics sectors.

Within this changing environment, different trends can be observed depending on the qualification of the workforce. The number of skilled workers (+3.3%) is growing twice as fast as the average for other profiles.

by sector Breakdown of temporary workers

by skills

Services – Transport/logistics – Trade – Construction – Industry

Managers and professionals. – Unskilled workers – Skilled workers – Employees

All French regions are quite dynamic, although two regions are in decline. The most dynamic region is Bourgogne Franche-Comté, with an increase of 9.3% over one year. Most of the other French regions show a similar increase in activity: Brittany 4.5%, Occitania 4%, Île-de-France 3.4%, Grand-Est 2.9%, Pays-de-la-Loire 2.8%, Normandy 2%, Auvergne Rhône-Alpes 2%, Centre Val-de-Loire 1.2%. However, two regions showed a decrease in the number of FTEs: Hauts de France -4.1%, Nouvelle-Aquitaine -3.1%.

Main trends in the sector

Looking to cover more territory:

The sector’s major clients require national coverage to meet all their labour requirements. The creation of new agencies to extend geographical coverage is time-consuming, and difficulties in recruiting permanent staff complicate the implementation of this strategy. Many groups combine internal development with targeted external growth transactions. For example, Partnaire acquired Adeva to strengthen its network in Brittany. Or Derichebourg’s Interim and Recruitment branch, which also expanded by acquiring Contact, two transactions assisted by AURIS Finance experts.

Improving solutions to labour shortages:

Among the main difficulties faced by operators in the sector, recruitment difficulties are the most important. In order to attract new candidates (fixed-term, permanent, temporary, etc.), operators in the sector have implemented various strategies. First of all, major communication efforts have been made. Communication campaigns have been launched on various digital platforms (social networks, audio streaming platforms, etc.). Another strategy has been to target people who have no contact with employment (young people, senior citizens, etc.). Providers in the sector have also developed a range of related services for temporary workers. Financial, HR or even carpooling services, such as Manpower’s partnership with Blablacar Daily, to offer an alternative means of transport. A strategy that allows for growth in recruitment and differentiation from competitors. Finally, many providers are offering programmes and tools to match temporary workers with promising jobs, whether through online programmes or temporary contracts with subsequent training periods.

Continued diversification of professions:

Temporary work agencies have moved from simply offering temporary work to providing a more complete human resources service (training, skills assessment, recruitment, outplacement, etc.). The aim is to reduce their exposure to temporary work and thus to different economic conditions. Some of these activities are more lucrative than the more traditional businesses of these operators. Finally, client companies are increasingly interested in working with a single point of contact in a particular area of activity. Hence the importance of diversifying the business lines on offer. This is nothing new, as we mentioned it in previous reports. It is evidence of a fundamental movement that will undoubtedly continue in the years to come.

A small market share for 100% digital services:

Digital is gaining a small share of the market in this sector, mainly driven by big operators in the market: Randstad acquired Side, imitating its competitor Adecco, which acquired Qapa in 2021. House of HR has acquired Staffme, a digital player in student recruitment.

Going digital does not prevent more traditional external growth. Many providers are investing in technology tools out of their own pockets to compete with digital-only players and/or to support the work of internal teams, relying on a “phygital” strategy (hybrid model).

The HR consultancy market

Our environment has been turned upside down by the Covid-19 health crisis, and the world of work is no exception to the general trend. This is reflected in an increase in recruitment difficulties. According to a study by Syntec Conseil, 37% of French companies now cite the availability and skills of the workforce as the main obstacle to competitiveness. According to the study, almost 84% of managers ranked hiring difficulties as the third biggest risk facing their company. This podium is dominated by the cost of energy, followed by the cost of raw materials. From a broader perspective, other factors are complicating the situation. Rising inflation is pushing up costs, including wages. The challenge is to remain competitive and retain employees with good working conditions. Add to this the desire of some employees for more meaning in their work and a greater appetite for CSR issues.

Faced with an increasingly complex environment, companies still have an existential need to recruit new talent. According to the Apec 2022 Barometer, French companies’ hiring needs have increased by 8 points compared to 2021. This trend has increased to +6 points for large companies and +4 points for small and medium-sized companies in the last quarter of 2022. HR consulting and recruitment companies therefore have a real opportunity to play a key role.

The latter have benefited from growth of 12% in 2021 and 10% in 2022. The macroeconomic context mentioned above is a key reason for this. HR consultancies and recruitment firms are even more in demand to fill this shortage of candidates. The strong appetite for CSR positions has also contributed to the growth of HR service providers. There are other factors behind this growth. Companies are turning to recruitment consultancies for their growing expertise. Whether it is in understanding needs or fine-tuning the selection of candidates, they are able to offer their clients the best assets. Consultancies can also respond better to their clients’ needs by specialising in certain sectors of activity. Although specialisation in one sector is a differentiating factor, many firms choose to diversify into several sectors in order to avoid being affected by a crisis in a single sector.

External growth is also part of the strategies of HR and recruitment consultancies. This is the case of Manpower with Tingari or Menway with MCG Managers.

What is the outlook for 2023?

M&A activity in the HR sector is expected to remain at a respectable level in 2023.

The market should continue to focus on easing internal development constraints, particularly related to hiring difficulties, and compensating for the retirement of many managers.

In summary, we expect transaction levels in 2023 to be similar to 2022.