Climate change and inflation hit the sector again

Following on from 2022, the warmest year in France since the beginning of the 20th century, 2023 was the second warmest year on record. With an average temperature of 14.4°C, the thermal anomaly for the year as a whole reached +1.4°C (compared to the 1991-2020 normal). As a result, the agri-food sector was again disrupted in 2023, not only by the weather, but also by rising energy and commodity prices. The war in Ukraine has completely disrupted raw material markets in Europe: the cost of energy, farm inputs, labour, and animal feed have soared. All this has been exacerbated by the build-up of European regulations, rising costs, and unfair competition against a backdrop of aid to Ukraine, which is undermining the French agri-food sector.

Sharp variations in production and prices

In 2023, the trend in national production shows marked disparities, with a significant increase for cereals, oilseeds, potatoes, and vines, while a decrease is seen for beetroot and most fruit and animal products. At the same time, farmgate prices for agricultural products (IPPAP) fell by 3.0% year-on-year, following a significant increase of 23.1% in 2022. This increase had been stimulated by a sharp acceleration in agricultural and energy commodity prices linked to the conflict in Ukraine. Although prices remained high, exceeding the already high levels of 2021 by 19.4%, they declined in the first ten months of the year, mainly due to a significant drop in cereal (-27.0%) and oilseed (-36.1%) prices, resulting from abundant global supply and intense competition from Russian grain.

In the case of wine, demand is limited compared to availability, especially at the international level, and putting downward pressure on prices. Price trends for fruit and vegetables vary by type. Despite an average increase in livestock prices over the year, sluggish demand in a context of declining purchasing power led to a fall in prices at the end of the year. At the same time, the cost of farm inputs eased slightly by 0.5% year-on-year, after rising by 22.9% in 2022. This easing is the result of a fall in fertiliser prices (-22.0%) and energy prices (-4.2%), despite an increase in animal feed prices (+2.9%).

In conclusion, INSEE estimates that food product prices will have risen by 3.7% in December 2023 compared to December 2022.

Source:

An overview of mergers and acquisitions

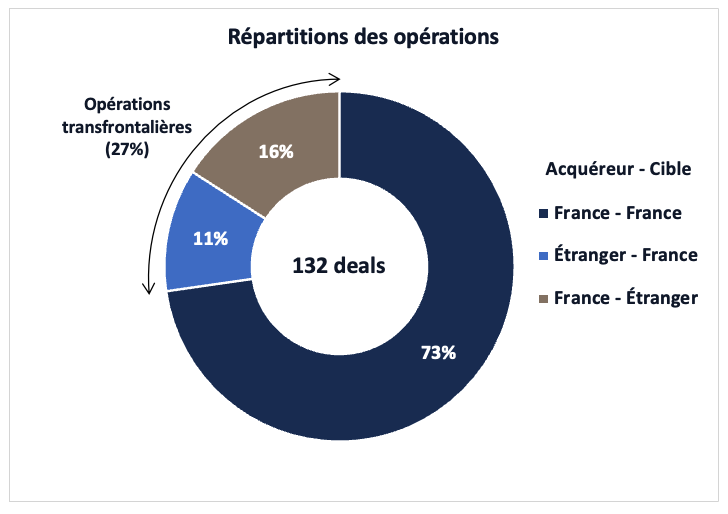

AURIS Finance has identified 132 transactions in the agri-food sector in 2023. These include at least one French counterparty (buyer or target).

Of the 132 transactions listed, 15 were carried out by foreign buyers (the acquisition of Courvoisier by Italy’s Campari, the acquisition of Cognac Larsen by the UK’s International Beverage, and the Polish group Stock Spirit Group, which bought Clan Campbell from the French group Pernod Ricard), accounting for 11% of the total number of transactions.

In addition, 21 transactions (16% of the total for the year) were carried out by French companies outside France: LDC’s acquisition of the Polish turkey leader Indykpol, Lactalis’ acquisition of Marie Morin Canada, and Pernod Ricard’s purchase of the American brand Skrewball Whiskey.

The remaining 96 transactions were all between French companies, including the acquisition of Minuty by Moët Hennessy, the acquisition of Hermes Boissons by the Agromousquetaires group, and the acquisition of Goulibeur by Maison Duprez, advised on the sale by AURIS Finance.

Transactions breakdown

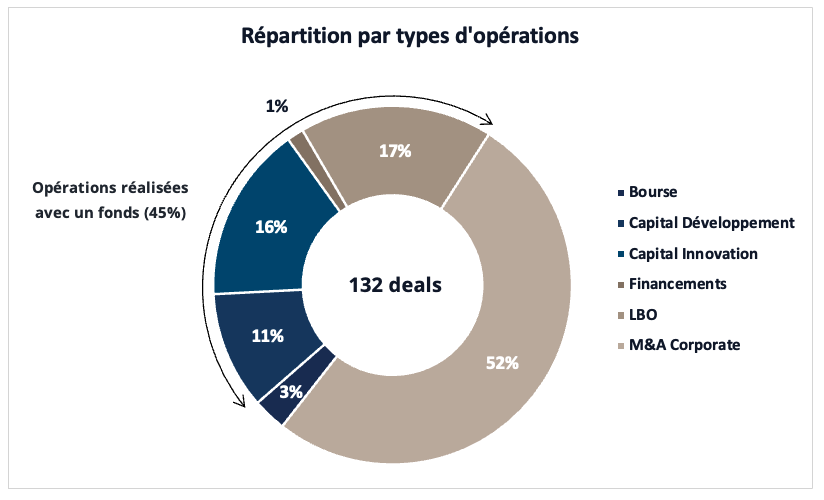

Of the 132 transactions carried out, 48 were completed with funds raised during the year (i.e. 45% of the total number of transactions recorded). Some industrial groups chose to acquire companies rather than develop new plants in order to gain access to existing clients and sales, as well as to integrate a company with existing employees into the target business, thereby overcoming recruitment challenges in certain geographic locations.

Breakdown by transaction type

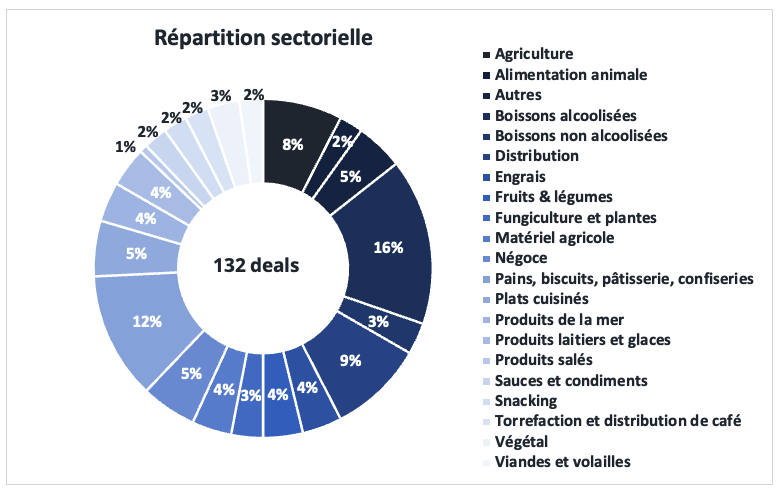

From a sectoral point of view, the alcoholic beverages sector leads our ranking with 16% of the volume of transactions recorded over the year (Enowe – Brana, Solexia – Domaine des terres de Velle, etc.), followed by the bread, biscuits, pastries and confectionery sector with 12% of the volume of transactions (Morato – Usine Harry’s, La fabrique cookies – Les p’tits amoureux, etc.). There is some balance in other sectors.

Breakdown by sector

In conclusion, AURIS Finance sees four major trends:

- In response to rising prices, the French have reduced their food purchases, with a growing tendency to systematically focus on lower-priced products. A more rational approach to consumption is beginning to take hold, complementing the trend towards more environmentally friendly behaviour (local, plant-based, etc.), although there are still some subtle nuances to this trend.

- After two consecutive years of declining poultry consumption in France, consumption increased in 2023 (+4.1%). The industry has shown great resilience following a two-year period marked by avian influenza.

- The alcoholic beverages sector was on a roll in 2023: 21 transactions compared with 11 in 2022 and 13 in 2021. The alcoholic beverages industry remained buoyant after months of sluggishness in 2022 and 2023, and France remains the world’s leading wine producer.

- Investment funds remain very interested in the agri-food sector, despite the difficult context (war in Ukraine, inflation, farmers’ protests, etc.). They backed almost half (45%) of all transactions in the sector in 2023.

| Transaction date | Buyer | Buyer country | Target company | Target country | Target activity | Transaction type |

|---|---|---|---|---|---|---|

| 1/2/2023 | MALTERIES SOUFFLET | France | LA MALTERIE DU CHÂTEAU | Belgique | Agriculture | M&A Corporate |

| 1/4/2023 | BUSINESS ANGEL(S) , CREAZUR , FAMILY OFFICES , OLBIA INVEST , REGION SUD INVESTISSEMENT , CREDIT AGRICOLE CHARENTE PERIGORD , CREDIT AGRICOLE AQUITAINE , PARIS BUSINESS ANGELS (PBA) | France | MYCOPHYTO | France | Engrais | Capital Innovation |

| 1/4/2023 | OTIUM CAPITAL | France | CAATS | France | Alimentation animale | Capital Innovation |

| 1/5/2023 | FRENCHFOOD CAPITAL (FFC) | France | HUILERIE G I D | France | Négoce | LBO |

| 1/6/2023 | PAI PARTNERS | France | NOVATASTE | France | Sauces et condiments | Capital Développement |

| 1/11/2023 | ÉTABLISSEMENTS LARRIEU | France | AGRISERVICE | France | Matériel agricole | M&A Corporate |

| 1/16/2023 | NEPTUNE ELEMENTS | France | ARVORIG SOLUTIONS | France | Fungiculture et plantes | M&A Corporate |

| 1/26/2023 | DEMETER | France | MALTIVOR (WONDERWOMALT) | France | Autres | Capital Innovation |

| 1/27/2023 | NACTIS FLAVOURS | France | ETS TRABLIT | France | Torrefaction et distribution de café | M&A Corporate |

| 1/31/2023 | KVERNELAND GROUP | Norvège | PHENIX AGROSYSTEM (B.C. TECHNIQUE AGRO-ORGANIQUE) | France | Matériel agricole | M&A Corporate |

| 1/31/2023 | KREAXI , ANGELOR | France | LOUTSA | France | Torrefaction et distribution de café | Capital Innovation |

| 2/1/2023 | LAFFORT | France | EVV (ENSEMBLE DE LA VIGNE AU VIN) | France | Boissons alcoolisées | M&A Corporate |

| 2/3/2023 | UNEXO , NORMANDIE PARTICIPATIONS | France | SOUDRY | France | Fruits & légumes | LBO |

| 2/6/2023 | COLRUYT GROUP | Belgique | DEGRENNE DISTRIBUTION | France | Distribution | M&A Corporate |

| 2/6/2023 | CANA HOLDING | France | MILLÉSIMES SAS | France | Négoce | M&A Corporate |

| 2/9/2023 | UI INVESTISSEMENT , SOCIÉTÉ FINANCIÈRE DU LANGUEDOC ROUSSILLON (SOFILARO) , REGION SUD INVESTISSEMENT , CAAP CREATION , OCCIPAC , BANQUE DES TERRITOIRES , INCO VENTURES (EX LE COMPTOIR DE L’INNOVATION CDI INVESTISSEMENT) , COLAM IMPACT , A PLUS FINANCE MARSEILLE (EX FINADVANCE) | France | FUTURA GAIA | France | Agriculture | Capital Innovation |

| 2/16/2023 | PAI PARTNERS | France | COMPAGNIE DES DESSERTS | France | Distribution | LBO |

| 2/16/2023 | EUROPE SNACKS | France | BURTS SNACKS | Royaume-Uni | Snacking | LBO |

| 2/20/2023 | MOËT HENNESSY | France | MINUTY | France | Boissons alcoolisées | M&A Corporate |

| 3/1/2023 | SOCIETE GENERALE CAPITAL PARTENAIRES , FINORPA | France | MAISON DUPREZ (EX TRADITION DU NORD) | France | Pains, biscuits, pâtisserie, confiseries | LBO |

| 3/6/2023 | ONORÉ (EX BONCOLAC) | France | PROPER CORNISH | Royaume-Uni | Snacking | LBO |

| 3/7/2023 | SOLINA GROUP | France | LYNCH FOODS | Canada | Plats cuisinés | LBO |

| 3/7/2023 | SILL ENTREPRISES | France | TERRE D EMBRUNS | France | Pains, biscuits, pâtisserie, confiseries | M&A Corporate |

| 3/10/2023 | INVIVO , GROUPE CASINO , TERACT (EX 2MX ORGANIC) | France | TERACT FERME France | France | Distribution | M&A Corporate |

| 3/10/2023 | FRANCE PIVOTS | France | CHALLENGE AGRICULTURE SARL | France | Agriculture | M&A Corporate |

| 3/21/2023 | PERNOD RICARD | France | SKREWBALL WHISKEY | Etats-Unis | Boissons alcoolisées | M&A Corporate |

| 3/22/2023 | GROUPE REYBIER | France | SOCIETE CIVILE D’EXPLOITATION DES DOMAINES REYBIER | France | Boissons alcoolisées | M&A Corporate |

| 3/22/2023 | Banques | France | MAITRES LAITIERS DU COTENTIN | France | Produits laitiers et glaces | Financement |

| 3/24/2023 | VESPER INVESTISSEMENT | France | DEBAUVE ET GALLAIS | France | Pains, biscuits, pâtisserie, confiseries | Capital Développement |

| 3/28/2023 | ISATIS CAPITAL | France | BIOSWELL | France | Engrais | LBO |

| 3/29/2023 | ENOWE | France | BRANA | France | Boissons alcoolisées | M&A Corporate |

| 3/30/2023 | AROMATAGROUP (NACTAROME) | Italie | FOODTASTE | France | Produits de la mer | M&A Corporate |

| 3/30/2023 | BUSINESS ANGEL(S) | France | TRANCHE (CHEZ PEPITE) | France | Pains, biscuits, pâtisserie, confiseries | Capital Innovation |

| 3/31/2023 | MAISON DUPREZ (EX TRADITION DU NORD) | France | BISCUITERIE AUGEREAU | France | Pains, biscuits, pâtisserie, confiseries | M&A Corporate |

| 4/3/2023 | NORMANDIE PARTICIPATIONS , AGRO INVEST , CAISSE D’EPARGNE NORMANDIE CAPITAL (CEN CAPITAL) , | France | LES CHEVALIERS D’ARGOUGES | France | Pains, biscuits, pâtisserie, confiseries | LBO |

| 4/3/2023 | CAPAGRO , CAPHORN INVEST , BNP PARIBAS DEVELOPPEMENT , SWEN CAPITAL PARTNERS , UI INVESTISSEMENT | France | AGRIODOR | France | Agriculture | Capital Innovation |

| 4/4/2023 | DAMIEN DE JONG | France | SYNERGY FOODS | France | Viandes et volailles | M&A Corporate |

| 4/12/2023 | AMDG PRIVATE EQUITY | France | ALINE & OLIVIER | France | Pains, biscuits, pâtisserie, confiseries | Capital Développement |

| 4/13/2023 | CREADEV , ACUMEN , DOB EQUITY , ENDEAVOR , HESABU CAPITAL | France | VICTORY FARMS | Kenya | Distribution | Capital Innovation |

| 4/17/2023 | BUSINESS ANGEL(S) | France | CHICHE! | France | Distribution | Capital Innovation |

| 4/20/2023 | AVRIL | France | SUNBLOOM PROTEINS | Allemagne | Distribution | M&A Corporate |

| 4/24/2023 | LE COMPTOIR DE MATHILDE | France | MAISON DE LA CHATINE | France | Pains, biscuits, pâtisserie, confiseries | M&A Corporate |

| 4/25/2023 | NESTLE , PAI PARTNERS | France | JV NESTLÉ / PAI PARTNERS | Allemagne | Plats cuisinés | M&A Corporate |

| 4/28/2023 | LIMAGRAIN | France | VILMORIN & CIE | France | Engrais | Bourse |

| 4/28/2023 | NOTUS TECHNOLOGIES | France | BENOIT CHOCOLATS | France | Pains, biscuits, pâtisserie, confiseries | M&A Corporate |

| 5/1/2023 | NISHIMOTO | Japon | COMPTOIR DES 3 CAPS (FISH IS LIFE) | France | Produits de la mer | M&A Corporate |

| 5/2/2023 | SAVEL | France | LA TOQUE BRETONNE | France | Viandes et volailles | M&A Corporate |

| 5/3/2023 | SANDERS | France | ACTIVITÉS DE NUTRITION ANIMALE D’AXÉRÉAL | France | Alimentation animale | M&A Corporate |

| 5/4/2023 | FG BROS | Belgique | CHAMPAGNE A. R. LENOBLE | France | Boissons alcoolisées | M&A Corporate |

| 5/9/2023 | AQTON , CIBUS FUNDS , SWISSCANTO , YARA , FLEXSTONE PARTNERS (EX EURO PRIVATE EQUITY) , SWISSCOM VENTURES , BASF VENTURE CAPITAL , 4FOX VENTURES | France | ECOROBOTIX SA | Suisse | Fungiculture et plantes | Capital Innovation |

| 5/15/2023 | NORD CAPITAL PARTENAIRES , TURENNE GROUPE , SOFIPACA | France | RÉSEAU VITALIS | France | Négoce | LBO |

| 5/16/2023 | MORATO | Italie | USINE HARRY’S | France | Pains, biscuits, pâtisserie, confiseries | M&A Corporate |

| 5/23/2023 | MOULIN DE LA VEYSSIERE | France | NOYERAIE DU LANDER | France | Agriculture | M&A Corporate |

| 5/23/2023 | CHARENTE PERIGORD EXPANSION | France | MOULIN DE LA VEYSSIERE | France | Agriculture | Capital Développement |

| 5/25/2023 | MAISON LEROY , OUVRARD NOUTS | France | AGI-SERRE | France | Fruits & légumes | M&A Corporate |

| 5/31/2023 | MYBRAZIL FACTORY | France | JUSTE PRESSE | France | Boissons non alcoolisées | M&A Corporate |

| 6/1/2023 | MAISON JOSEPH DROUHIN , MILLESIME | France | CHÂTEAU DE CHASSELAS | France | Boissons alcoolisées | M&A Corporate |

| 6/1/2023 | MYBRAZIL FACTORY | France | LA JUCERIE | France | Boissons non alcoolisées | M&A Corporate |

| 6/1/2023 | MAISON JOSEPH DROUHIN | France | DOMAINE RAPET JEAN-FRANCOIS | France | Boissons alcoolisées | M&A Corporate |

| 6/1/2023 | AGROMOUSQUETAIRES | France | HERMES BOISSONS | France | Boissons non alcoolisées | M&A Corporate |

| 6/8/2023 | PERSONNE(S) PHYSIQUE(S) | France | JAY & JOY | France | Végétal | M&A Corporate |

| 6/9/2023 | HIGH FLYERS CAPITAL (HFC) | France | JAY & JOY | France | Végétal | Capital Innovation |

| 6/12/2023 | CONSTELLATION , IMPACT BUSINESS ANGELS | France | ELOI | France | Négoce | Capital Innovation |

| 6/12/2023 | FNB PRIVATE EQUITY | France | CAFÉS LEGAL | France | Torrefaction et distribution de café | LBO |

| 6/12/2023 | BUSINESS ANGEL(S) | France | FEVE (FERMES EN VIE) | France | Négoce | Capital Innovation |

| 6/15/2023 | SOFIPROTEOL , WALLONIE ENTREPRENDRE , SOCIETE FEDERALE DE PARTICIPATIONS ET D’INVESTISSEMENT (SFPIM) | France | COSUCRA | Belgique | Agriculture | Capital Développement |

| 6/15/2023 | IDIA CAPITAL INVESTISSEMENT , CRÉDIT AGRICOLE RÉGIONS INVESTISSEMENT (CARVEST) | France | DAMMANN FRERES | France | Boissons non alcoolisées | Capital Développement |

| 6/19/2023 | INCO VENTURES (EX LE COMPTOIR DE L’INNOVATION CDI INVESTISSEMENT) , LITA.CO (EX 1001PACT) | France | BISCORNU | France | Plats cuisinés | Capital Innovation |

| 6/20/2023 | DANONE COMMUNITIES , BUREAU VALLÉE , BANQUE DES TERRITOIRES , PARIS BUSINESS ANGELS (PBA) , IMPACT BUSINESS ANGELS , WISEED | France | RESAN | France | Autres | Capital Innovation |

| 6/30/2023 | HEARTCORE CAPITAL (EX SUNSTONE CAPITAL) , HCVC (ELEPHANTS & VENTURES) , SOCIETE FINANCIERE SAINT JAMES , KIMA VENTURES , KOST CAPITAL | France | NUMI (EX MUMILK) | France | Autres | Capital Innovation |

| 7/3/2023 | BUSINESS ANGEL(S) | France | HECTAREA | France | Autres | Capital Innovation |

| 7/3/2023 | CALCIUM CAPITAL | France | BIOGROUPE | France | Végétal | Capital Développement |

| 7/7/2023 | QUATERRA (EX BIO CONQUETE – FRENCH GOURMET FOOD) | France | LES DUCS DE GASCOGNE | France | Distribution | M&A Corporate |

| 7/10/2023 | ARTEMIS DOMAINES | France | WILLIAM FEVRE | France | Boissons alcoolisées | M&A Corporate |

| 7/11/2023 | UNEXO | France | GLACES MOUSTACHE | France | Produits laitiers et glaces | LBO |

| 7/17/2023 | SEPAL | France | CENTRALIAA | France | Distribution | M&A Corporate |

| 7/18/2023 | SOLEXIA | France | DOMAINE DES TERRES DE VELLE | France | Boissons alcoolisées | LBO |

| 7/19/2023 | EURONEXT (BOURSE), SAFFELBERT INVESTMENTS | France | VINPAI | France | Distribution | Bourse |

| 7/20/2023 | QUINOAK | France | LOCADELICE | France | Fungiculture et plantes | M&A Corporate |

| 7/25/2023 | Banques | France | LOUIS DREYFUS COMPANY | France | Négoce | Financement |

| 7/26/2023 | AVRIL | France | HARI&CO | France | Fruits & légumes | M&A Corporate |

| 7/26/2023 | UNIGRAINS , BPIFRANCE INVESTISSEMENT | France | OTICO | France | Matériel agricole | LBO |

| 8/1/2023 | OLMA CAPITAL MANAGEMENT , THE LUXURY FUND , EXPANSO CAPITAL , CHARENTE PERIGORD EXPANSION , CAISSE D’EPARGNE AQUITAINE POITOU-CHARENTES (CEAPC) | France | GROUPE PRUNIER | France | Produits de la mer | M&A Corporate |

| 8/1/2023 | OLMA CAPITAL MANAGEMENT | Irlande | GROUPE PRUNIER | France | Produits de la mer | Capital Développement |

| 8/1/2023 | FAMAE IMPACT , GALIA GESTION | France | NOVAG | France | Matériel agricole | Capital Développement |

| 8/1/2023 | LACTALIS | France | MARIE MORIN CANADA | Canada | Plats cuisinés | M&A Corporate |

| 8/4/2023 | EUREDEN | France | OVOFIT | Allemagne | Distribution | M&A Corporate |

| 8/18/2023 | BPIFRANCE INVESTISSEMENT , ASTANOR VENTURES (GOOD HARVEST VENTURES MANAGEMENT) , REDALPINE VENTURE PARTNERS , VERSO FUND , KIMA VENTURES , NEWFUND , FRENCH PARTNERS | France | UMIAMI | France | Végétal | Capital Innovation |

| 8/24/2023 | PAI PARTNERS | France | ALPHIA | Etats-Unis | Alimentation animale | LBO |

| 8/28/2023 | AGRISTO | Belgique | SUCRERIE TEREOS D’ESCAUDŒUVRES | France | Pains, biscuits, pâtisserie, confiseries | M&A Corporate |

| 8/28/2023 | SOCIÉTÉ PORC MONTAGNE | France | MAISON SERRAULT | France | Plats cuisinés | M&A Corporate |

| 9/1/2023 | CREDIT MUTUEL EQUITY , BPIFRANCE INVESTISSEMENT | France | ASTER DÉVELOPPEMENT | France | Produits salés | LBO |

| 9/1/2023 | COMPAGNIE LÉA NATURE (LÉA NATURE, BIOLÉA, EKIBIO) | France | BERNARD JARNOUX | France | Pains, biscuits, pâtisserie, confiseries | M&A Corporate |

| 9/3/2023 | PERSONNE(S) PHYSIQUE(S) | France | MARJORIE ET STEPHANE GALLET | France | Boissons alcoolisées | M&A Corporate |

| 9/4/2023 | STOCK SPIRITS GROUP | Pologne | CLAN CAMPBELL | France | Boissons alcoolisées | M&A Corporate |

| 9/5/2023 | STOCK SPIRITS GROUP | Pologne | ETABLISSEMENTS DUGAS | France | Négoce | M&A Corporate |

| 9/6/2023 | INTERNATIONAL BEVERAGE | Royaume-Uni | COGNAC LARSEN | France | Boissons alcoolisées | M&A Corporate |

| 9/7/2023 | ISALT – INVESTISSEMENT STRATEGIQUES EN ACTIONS LONG TERME , AXEREAL | France | INTACT | France | Fruits & légumes | Capital Innovation |

| 9/8/2023 | DE SANGOSSE | France | ISCA | Etats-Unis | Engrais | M&A Corporate |

| 9/15/2023 | LACTALIS | France | LA FERME D’ALEXANDRE | France | Produits laitiers et glaces | M&A Corporate |

| 9/18/2023 | DUVEL MOORTGAT | Belgique | BRASSERIE DU MONT-BLANC | France | Boissons alcoolisées | M&A Corporate |

| 9/20/2023 | SMALT CAPITAL | France | ROYAL BOURBON INDUSTRIES | France | Distribution | Capital Développement |

| 9/26/2023 | CAISSE D’EPARGNE (GROUPE) , GROUPE BANQUE POPULAIRE , BPIFRANCE INVESTISSEMENT | France | RHIZOSFER | France | Agriculture | Capital Innovation |

| 9/28/2023 | TERROIRS & VIGNERONS DE CHAMPAGNE (EX CENTRE VINICOLE CHAMPAGNE NICOLAS FEUILLATTE) | France | CHAMPAGNE HENRIOT | France | Boissons alcoolisées | M&A Corporate |

| 9/30/2023 | CULTIMER | France | KERMAREE | France | Produits de la mer | M&A Corporate |

| 10/4/2023 | MAISON DUPREZ | France | GOULIBEUR | France | Pains, biscuits, pâtisserie, confiseries | M&A Corporate |

| 10/5/2023 | LEFORT | France | BRANCHE D’ACTIVITÉ DELAVAL DE TARDIF-VASSAL | France | Agriculture | M&A Corporate |

| 10/6/2023 | CREDIT MUTUEL EQUITY | France | NATING | France | Sauces et condiments | LBO |

| 10/12/2023 | SOFINNOVA PARTNERS , SPARK FOOD , FINORPA | France | BON VIVANT | France | Produits laitiers et glaces | Capital Innovation |

| 10/16/2023 | MASCHIO GASPARDO , FINEST SPA | Italie | GREGOIRE-BESSON | France | Matériel agricole | M&A Corporate |

| 10/16/2023 | SODERO GESTION | France | LA BRASSERIE DU BOUFFAY | France | Boissons alcoolisées | LBO |

| 10/23/2023 | OMER-DECUGIS & CIE | France | CHAMPARIS | France | Fruits & légumes | M&A Corporate |

| 10/25/2023 | ATLANTIQUE BOISSONS | France | LES CELLIERS DE GRAND LIEU | France | Boissons alcoolisées | M&A Corporate |

| 10/27/2023 | TERRENA | France | TIPIAK | France | Plats cuisinés | Bourse |

| 10/30/2023 | SOLINA GROUP | France | JERMAYO | Belgique | Plats cuisinés | LBO |

| 11/1/2023 | MANAGER(S) | France | LE BAR MOULINS D’ASCQ | France | Boissons alcoolisées | M&A Corporate |

| 11/8/2023 | LDC | France | INDYKPOL | Pologne | Viandes et volailles | M&A Corporate |

| 11/15/2023 | MALTERIES SOUFFLET , KKR , BPIFRANCE INVESTISSEMENT , CRÉDIT AGRICOLE RÉGIONS INVESTISSEMENT (CARVEST) , IDIA CAPITAL INVESTISSEMENT , NORD EST PARTENAIRES (EX NORD EST EXPANSION) | France | UNITED MALT GROUP | Australie | Agriculture | Bourse |

| 11/22/2023 | HOLDING(S) FAMILIAU(X) | France | CHAMPAGNE PIERRE PETERS | France | Boissons alcoolisées | M&A Corporate |

| 11/23/2023 | SOFIPROTEOL | France | MARTIN POURET | France | Sauces et condiments | Capital Développement |

| 11/27/2023 | LT CAPITAL , RIVES CROISSANCE | France | LALOS PARIS | France | Pains, biscuits, pâtisserie, confiseries | LBO |

| 12/6/2023 | MIROVA , HALTRA , MIRABAUD ASSET MANAGEMENT PRIVATE EQUITY , ZEBRA IMPACT | France | KOA | Suisse | Autres | Capital Développement |

| 12/6/2023 | FERRERO | Italie | MICHEL ET AUGUSTIN | France | Snacking | M&A Corporate |

| 12/12/2023 | BRIOIS | France | AGRAL SA / JM CABAY SA | Belgique | Produits laitiers et glaces | M&A Corporate |

| 12/12/2023 | ESFIN GESTION , TRIODOS INVESTMENT MANAGEMENT (TRIODOS IM) | France | GROUPE NATIMPACT | France | Autres | Capital Développement |

| 12/12/2023 | GROUPE NATIMPACT | France | BASE ORGANIC FOOD | France | Distribution | LBO |

| 12/13/2023 | SOCIÉTÉ D’EXPLOITATION DU CHÂTEAU GISCOURS (SECG) | France | DOMAINE VITICOLE DU CHÂTEAU GISCOURS | France | Boissons alcoolisées | M&A Corporate |

| 12/14/2023 | ONORÉ (EX BONCOLAC) | France | CAKESMITHS | Royaume-Uni | Pains, biscuits, pâtisserie, confiseries | LBO |

| 12/14/2023 | CAMPARI | Italie | COURVOISIER | France | Boissons alcoolisées | M&A Corporate |

| 12/18/2023 | BREIZH REBOND | France | EUROSUBSTRAT CALLAC | France | Fungiculture et plantes | LBO |

| 12/19/2023 | LA FABRIQUE COOKIES | France | LES P’TITS AMOUREUX (LPA) | France | Pains, biscuits, pâtisserie, confiseries | M&A Corporate |

| 12/26/2023 | SOFINA , TIKEHAU IM , M&G INVESTMENTS , UNIGRAINS , SOFIPROTEOL | France | BIOBEST | Belgique | Engrais | Capital Développement |