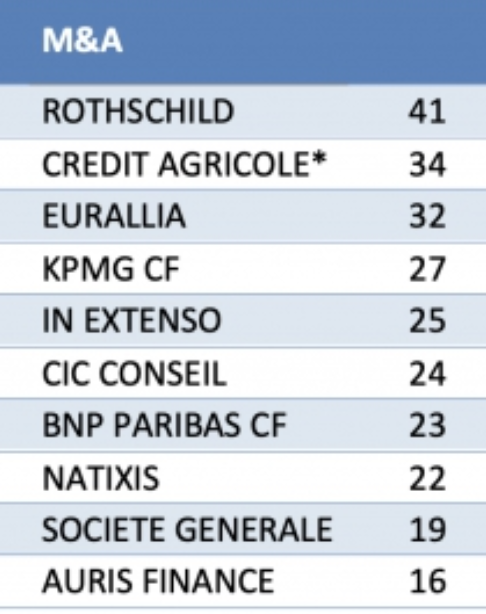

Which are the most dynamic investment banks in France in terms of M&A transactions? According to the CFNEWS ranking, AURIS Finance is still in the top ten French players for M&A transactions in 2022.

Each year, CFNEWS, a media specialising in private equity, LBO, M&A, venture capital, corporate finance and private equity news, publishes its ranking of the most influential players on the French market. This ranking, based on the three CFNEWS databases, provides an overview of the advisory or investment mandates secured by the various advisers according to five types of transaction: IPO, M&A, LBO, expansion capital and innovation capital.

Sixteen transactions completed by AURIS Finance in 2022

In 2022, we are among the top ten most dynamic French investment banks in the M&A category. With sixteen transactions completed during the year, AURIS Finance ranks just behind the Société Générale Group, which has a total of 19 M&A transactions for 2022. This is a significant achievement given the less buoyant economic backdrop. In 2022, CFNEWS counts 2,361 transactions compared to 2,649 in the previous year, a decrease of 10.9% for all transactions analysed – IPOs, M&A, LBOs, expansion capital and innovation capital. This downward trend can be explained by a catch-up effect: 2021 – after the covid health crisis – having been particularly dynamic, but also by an uncertain macroeconomic environment that makes investors more cautious.

M&A and financial engineering consulting

As CFNEWS notes in its ranking, while the overall number of deals declined between 2021 and 2022, advisory mandates for small and mid-cap transactions are on the rise again. In addition to mega-deals, many smaller deals were completed in 2022 with the help of investment banks. When it comes to acquisitions or divestments, companies have a real need for advice. After sixteen M&A transactions closed in 2022, 2023 is also turning out to be a promising year for AURIS Finance. Our experts, who are specialised in different sectors, all have operational experience and most of them are former company directors. In addition to financial engineering and M&A advice, AURIS Finance supports company managers in their day-to-day business. They are intimately familiar with their markets and have an extensive network at their disposal. Depending on the client’s strategy, they are able to quickly identify potential investors and targets.

Our experts are at your side

Despite an uncertain economic environment, 2023 still heralds many opportunities. Although financing has dried up with the rise in interest rates, French companies continue to attract investors. Some sectors remain particularly attractive, such as the waste management, technology and human resources sectors. Whatever your project, AURIS Finance experts are here to help you.