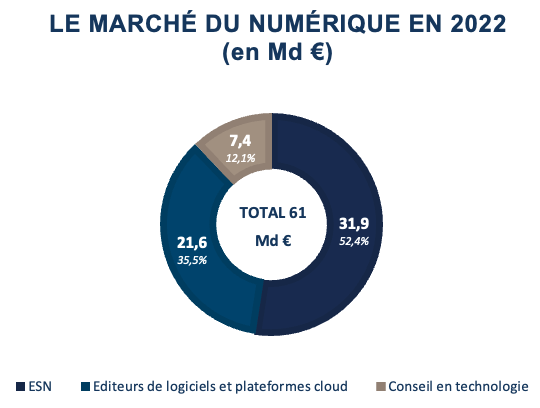

A resilient and still growing market

The digital market continued to grow in 2022, driven by a positive underlying trend that began a few years ago and spurred on by Covid, which highlighted the technological lag of French companies.

Across its various subsectors (software publishers, IT services and consulting), the French digital market has reached €61 billion, an increase of 7.5% compared to 2021. Despite an unstable economic and geopolitical environment in 2022, digital transformation will remain at the heart of companies’ strategic challenges.

Among the different sectors, software publishers and cloud platforms performed well with an average growth of 11.3% over the year. Their solutions, which offer operational simplicity and improved accessibility, make it possible to respond effectively to the expectations of clients and employees.

IT service providers as a whole experienced more subdued growth, with an average increase of 5.3%, although there were some disparities according to company size and business areas served. For example, integrators, which focus on implementing solutions and developing applications, outperformed the market. They ended the year with an average revenue increase of 21.5%. In contrast, IT service providers specialising in managed services experienced sluggish growth and are still suffering from the massive migration to cloud infrastructures.

Finally, IT consulting companies, whose porosity with IT service providers remains as high as ever, also benefited from this positive trend, with average growth of around +7.4% in 2022.

THE DIGITAL MARKET IN 2022

(in € billion)

IT service providers – Software publishers and cloud platforms – IT consultancies

Key trends in the sector

This strong and sustained digital transformation is spreading to all sectors of the French economy. Supported by growing business investment (+14% in 2022) in IT equipment and software solutions, it is driven by several factors:

- a need to optimise all operational functions (finance, purchasing, HR, logistics, etc.) to improve productivity

- Anticipate the more demanding and selective needs of clients and employees by offering them a higher quality experience and a more flexible working environment.

- a need to guarantee data protection for all.

These developments have highlighted a number of key trends in 2022, which we will try to describe below.

A market driven by the cloud and cyber security

SaaS software publishers are benefiting from the continuing migration of companies to remote infrastructures (cloud computing) to manage and store their data, and to develop new revenue streams, in particular through the development of intelligent solutions (AI).

This gradual deployment, which is de facto increasing the volume of data transferred to the cloud, is raising new privacy issues and has boosted demand for cybersecurity solutions. Indeed, in the face of increasing cyber-attacks, companies are planning to step up their cyber defence budgets from 5% to 15% in 2023.

However, these structural changes are not without difficulties. Massive deployment in the cloud is leading to an increase in hosting costs, which publishers must manage carefully so as not to erode their margins too much.

A race to innovate and acquire new skills

To support their clients’ digital transformation, IT service providers are increasingly turning to high value-added services incorporating cutting-edge technologies (AI, big data, cloud computing).

Faced with the growing adoption of basic technologies, software publishers are also forced to devote an increasing share of their resources to R&D (17% of their workforce in 2020, compared to 14% in 2017) in order to improve their offerings and face competitive pressures. The trade-off between outdated solutions with high profitability and innovative tools better adapted to new uses, but still unprofitable, may prove difficult.

Acquiring fresh know-how by surrounding oneself with the most qualified profiles is thus a critical aspect in developing and distinguishing oneself from the competition.

A market still suffering from a talent shortage

According to one study, more than 80% of companies in the sector say they are experiencing recruitment difficulties. In fact, it is estimated that by 2025 there will be a need for 3.6 times the current number of employees.

The shortage of highly qualified professionals is currently the main obstacle to the development of IT service companies and software publishers. They are compelled to raise salaries and invest in the quality of life at work. In the long term, this could put pressure on margins and slow down their ability to innovate.

Responding to a tight market in different ways

To address this key issue, companies are experimenting with different solutions. In addition to working on their employer brand to increase employee and prescriber engagement, companies are turning to other alternatives.

For example, IT service companies are increasingly turning to freelance workers or to international sourcing by means of offshoring. This is a way of accessing skilled labour that is not available in their home territories, while limiting their staffing costs.

For their part, software publishers see low code as a partial answer to this recruitment challenge. These solutions make it possible to speed up development phases while limiting the need to recruit specialists, although there is a risk of substitution due to the inherent characteristics of this software.

Finally, in 2022, growing externally was once again a response widely favoured by those operating in the sector. Whether to diversify or strengthen, these operations save time and skills.

The M&A market in 2022

Despite a more complex economic environment, the M&A market in the technology sector remained at a level close to that of previous years (excluding 2021, an exceptional year), with a transaction volume close to €5 billion (including IPO sales).

Capital transactions reflected the main trends that emerged in 2022. The pursuit of cybersecurity skills has been one of the drivers of many transactions, such as Framatome’s acquisition of Cyberwatch, a French cybersecurity software publisher. or Harris France’s acquisition of Azur Soft. Cloud technologies were also in high demand, as illustrated by Doctolib’s acquisition of Tanker, a start-up specialising in data encryption in the cloud.

There has also been a strategic reorientation of IT service companies towards higher value-added businesses. The current restructuring of Atos is a perfect example. In fact, the group has decided to split in two to regroup its strategic and lucrative cybersecurity and cloud activities under the name Evidian. On the other hand, it will retain its core activities in the management of data centre infrastructures. To this end, the group has acquired Cloudreach to strengthen its security and multi-cloud capabilities, and is finalising the sale of Unify, specialised in unified communications, at the beginning of 2023.

As for the Capgemini Group, it has completed the acquisition of Quantmetry in order to strengthen its capabilities in AI and data modelling.

Internationalisation of the offering to access new commercial markets was another very important area of development: Edit-info (Morocco) joined the Inetum Group to accelerate its international development, and Braincourt joined Capgemini to strengthen its presence in Germany and Northern Europe.

Recruitment issues also played a role in the justification of investment projects. In March 2022, Capgemini announced the launch of its freelance sourcing platform in Europe. Atos has resorted to offshoring by opening a global delivery centre in Egypt to access additional low-cost labour.

What is the outlook for 2023?

The digital transformation that has been underway for several years is expected to continue in 2023. The need for cloud, big data, IoT and cybersecurity solutions is expected to remain high, supported by ever-increasing ICT budgets. The market is expected to grow by around 8%.

Given the many challenges that digital market players will continue to face (talent shortage, offering enrichment, integration of greener technologies), M&A activity should remain buoyant in 2023, despite higher financing costs than before.

Sources:

Numeum, Bloomberg Law, Le Figaro, LesEchos, Le Monde Informatique, Xerfi, EY, Avolta

Examples of M&A transactions in 2022 involving French IT players[i]

| Target company | Type of transaction | Target turnover (M€) | Buyer/investor | Target Activity | Transaction date |

|---|---|---|---|---|---|

| INETUM – GFI INFORMATIQUE | Fundraising | 2300 | BAIN CAPITAL | Infogérance | 2022-01 |

| UMANIS | M&A | 245 | CGI | SSII | 2022-03 |

| CS Group | M&A | 173 | SOPRA STERIA | Création et la gestion de systèmes | 2022-11 |

| Methods | M&A | 110 (GBP) | ALTEN | Transformation digitale pour les services publics au Royaume-Uni | 2022-05 |

| CEGEDIM SANTÉ | M&A | 100 | MALAKOFF HUMANIS|GROUPE VYV|PRO BTP | Accompagnement des professionnels de santé et de leurs patients | 2022-03 |

| VALIANTYS | M&A | 98 | KEENSIGHT CAPITAL | SSII | 2022-04 |

| TOBANIA | M&A | 97.8 | SOPRA STERIA | Transformations numériques | 2022-11 |

| HR TEAM | M&A | 95 | SCALIAN EUROGICIEL | SSII | 2022-09 |

| SEDIA | M&A | 91 | CEGEDIM | Editeur de logiciels médicaux | 2022-09 |

| VINATIS | M&A | 70 | CASTEL FRERES | E-commerce de vins, champagnes et spiritueux | 2022-09 |

| ICONCEPT | M&A | 70 | C&C | Distributeur Matériel Info | 2022-01 |

| AVITI | M&A | 61 | KOESIO (EX C’PRO) | Services et conseils en solutions d’infrastructure informatique | 2022-05 |

| METALINE | Fundraising | 60 | LFPI | Infrastructure Systèmes | 2022-09 |

| ALEDA | M&A | 53 | LA FRANCAISE DES JEUX | Editeur Logiciels | 2022-10 |

| AVEVA | M&A | 42 | SCHNEIDER ELECTRIC | Éditeur britannique de logiciels industriels | 2022-11 |

| SARBACANE | Fundraising | 30 | EMZ PARTNERS, IDI | Communication digitale des entreprises | 2022-11 |

| DEVERYWARE | M&A | 30 | CHAPSVISION (FLANDRIN TECHNOLOGIES) | Technologies d’investigation et des services pour la sécurité globale | 2022-09 |

| ALTERSIS | M&A | 30 | MOONGY | Informatique de production, systèmes d’information haute technologie | 2022-02 |

| EDITINFO-IT (Maroc) | M&A | 30 (Dirhams) | INETUM ex GFI INFOMATIQUE | Logiciels de gestion | 2022-05 |

| PICTIME GROUPE | M&A | 28 | CLARANET | Infogérance | 2022-09 |

| DAVEO | M&A | 28 | MAGELLAN PARTNERS | Conseil stratégique et IT | 2022-02 |

| GROUPE HISI | M&A | 26 | CONSTELLATION | Editeur Logiciels | 2022-11 |

| D²X EXPERTISE | Fundraising | 20 | BPI FRANCE INVESTISSEMENT, GARIBALDI PARTICIPATIONS | Sécurisation des engagements des DSI | 2022-01 |

| PRAXEDO | Fundraising | 17 | Éditeur de logiciel SaaS de « Field Service Management » | 2022-03 | |

| BE.WAN (Belgique) | M&A | 16 | ARTEMYS ex-PERMIS INFORMATIQUE | ESN : infrastructures IT | 2022-10 |

| TERSEDIA | M&A | 15.6 | SIPAREX | Infogérance | 2022-04 |

| GATEWATCHER | Fundraising | 15 | KEPLER CHEVREUX INVEST | Éditeur de logiciels de cybersécurité | 2022-02 |

| A2COM | M&A | 15 | FOLIATEAM | Infogérance | 2022-02 |

| QUANTIC DREAM | M&A | 14.4 | NETEASE | Jeux vidéo | 2022-08 |

| NOTILUS | M&A | 14.4 | CEGID GROUP | Editeur Logiciels | 2022-05 |

| OSLO [BRANCHE BI] | M&A | 14 | SYXPERIANE | Editeur Logiciels | 2022-01 |

| OPENBRAVO (Espagne) | M&A | 13 | DL SOFTWARE | Éditeur de logiciels | 2022-12 |

| CONIX | M&A | 13 | NEO-SOFT | SSII développement de logiciels client-serveur | 2022-02 |

| ALFUN | M&A | 13 | DEVOTEAM | Infogérance | 2022-01 |

| CIMEL | M&A | 12.4 | SIDEREL | Informatique Industrielle | 2022-10 |

| AQUITEM | M&A | 12 | FIDUCIAL INFORMATIQUE (ORGASOFT INFORMATIQUE) | Gestion de programmes de fidélité pour le compte de grandes enseignes de retail | 2022-10 |

| BEE2LINK | M&A | 12 | BYMYCAR (COSMOBILIS) | Solutions logicielles et digitales en mode SaaS pour les acteurs de l’automobile | 2022-10 |

| JUMP TECHNOLOGY | M&A | 12 | CLEARWATER ANALYTICS | Editeur Logiciels | 2022-10 |

| RH LUCCA | Fundraising | 12 | ONE PEAK | Éditeur de solutions RH | 2022-03 |

| SILVERPROD | M&A | 12 | KPMG | Intégrateur PGI | 2022-03 |

| VIVLIO | M&A | 11.5 | CULTURA / SODIVAL | Plateforme de distribution d’e-books | 2022-02 |

| LINKVALUE | M&A | 11 | POSITIVE THINKING COMPANY | Editeur Logiciels | 2022-02 |

| BRAINCOURT GMBH | M&A | 10 | CAPGEMINI | Data science et services de gestion de projets avancés | 2022-10 |

| MIMAT | M&A | 10 | PHENOMENE | Editeur Logiciels | 2022-09 |

| BLUESCALE | M&A | 10 | VINCI ENERGIES | Développement d’application pour Big data | 2022-03 |

| BLUESCALE | M&A | 10 | AXIANS | SSII | 2022-02 |

| OFA | M&A | 10 | FORTIUS | Infogérance | 2022-01 |

| PMI (SCOLARIS) | M&A | 9.7 | CM INFORMATIK AG | Logiciel scolaire | 2022-04 |

| MIND7 CONSULTING | M&A | 9 | KAPPA INVEST | Services du Numérique | 2022-05 |

| MISTRAL INFORMATIQUYE | M&A | 8.9 | APTEAN | Intégrateur PGI | 2022-12 |

| CYCLABLE | Fundraising | 8.9 | CALCIUM CAPITAL | Réseau de 60 magasins spécialisés dans la mobilité à vélo | 2022-03 |

| DECIDEOM | Fundraising | 8.7 | BPI FRANCE INVESTMENT, NCI | Consulting et vente de logiciels | 2022-09 |

| MIND7 CONSULTING | M&A | 8.7 | FONDATEUR(S)|MANAGER(S) | Conseils et services informatiques | 2022-05 |

| MAILINBLACK | Fundraising | 8.3 | APAX PARTNERS DEVELOPMENT, NEWALPHA VERTO | Éditeur de logiciel | 2022-09 |

| SOFTFLUENT | M&A | 8 | VERBUS | Développement applications Microsoft et conseil IT | 2022-05 |

| TMF France | M&A | 7.6 | ECONOM | Reconditionnement « made in France » de smartphones et tablettes | 2022-04 |

| L’ADDITION | M&A | 7.51 | LA FRANCAISE DES JEUX (FDJ) | Solutions de gestion d’encaissement et de paiement à destination des cafés, hôtels et restaurants. | 2022-07 |

| CHAPPUIS HALDER & CIE | M&A | 7.5 | CAPGEMINI | Conseil en stratégie et management spécialisé dans le secteur des services financiers | 2022-05 |

| KESYS | M&A | 7.5 | PROXITEAM | Transformation digitale | 2022-04 |

| MANUDAX FRANCE | M&A | 7.5 | MATLOG | Distribution Electrique/Elect | 2022-04 |

| COW HILLS (Pays-Bas) | M&A | 7 | DL SOFTWARE | Éditeur de logiciel SaaS de Commerce Unifié | 2022-12 |

| DISCNGINE | M&A | 7 | CHEMICAL COMPUTING GROUP | Editeur Logiciels | 2022-12 |

| ID SERVICES | M&A | 7 | HUB ONE | Distributeur Matériel Info | 2022-10 |

| MMH | M&A | 7 | MAGELLAN PARTNERS | Conseil, du développement et de l’intégration de solutions SAP et de la migration vers SAP S/4Hana | 2022-06 |

| ACII | M&A | 7 | AUDENSIEL | SSII | 2022-01 |

| SELLSY | Fundraising | 6.7 | PSG | Solutions logicielles | 2022-03 |

| RESEAUX SOLUTIONS SERVICES (R2S) | M&A | 6.62 | KOESIO (EX C’PRO) | Location et vente de matériel multimédia et d’impression | 2022-04 |

| YOURAX | M&A | 6.4 | ACESI GROUP | Infrastructure Systèmes | 2022-04 |

| ADVANCED MAGNETIC INTERACTI | M&A | 6.3 | BIC SA | Fabrication équipements numériques | 2022-09 |

| DIGITALRECRUITERS | M&A | 6 | CEGID GROUP | Intégrateur PGI | 2022-10 |

| MBV SI | M&A | 6 | MAGELLAN PARTNERS | Conseils en services informatiques spécialisés sur le fonctionnement de SAP HANA | 2022-08 |

| GENERATION CONSEIL | M&A | 6 | BK CONSULTING | Conseils en services informatiques | 2022-08 |

| VENTYA | M&A | 6 | EVERWIN | Plateforme Saas dédiée aux échanges de flux dématérialisés | 2022-04 |

| RS GROUPE | M&A | 5.87 | KOESIO (EX C’PRO) | Location et vente des systèmes d’impression et de bureautique | 2022-08 |

| FLUID-E | M&A | 5.7 | DATA DYNAMIC SYSTEMS – DDS LOGISTICS | Portail SaaS qui exécute les processus de supply chain interentreprises B2B | 2022-01 |

| AZUR SOFT | M&A | 5.4 | HARRIS FRANCE | Logiciels de gestion de plateformes de télésurveillance | 2022-11 |

| AZUR SOFT DEVELOPPEMENT | M&A | 5.4 | CONSTELLATION SOFTWARE – | Editeur Logiciels | 2022-11 |

| OPINION ACT | M&A | 5 | JIN | Services Internet | 2022-11 |

| GROUPE CYRES | M&A | 5 | ADISTA | Hébergement Internet | 2022-11 |

| DIRECT INFO SERVICE | M&A | 5 | CONSTELLATION | Infogérance | 2022-10 |

| EDUCLEVER | M&A | 5 | VIVENDI [EDITIS] | Editeur Logiciels | 2022-05 |

| CMS IT (INFOGÉRANCE DE CNIM) | M&A | 5 | FORTIL | Infogérance d’infrastructures | 2022-02 |

| Cloudreach | M&A | 4.96 | ATOS | Services multi-cloud | 2022-01 |

| 3D SOFT | M&A | 4.833 | BEE2LINK | Infogérance | 2022-01 |

| GLOBAL P.O. S | M&A | 4.8 | EVERWIN | Éditeur de solutions software dédiées au secteur du retail | 2022-05 |

| FIDENS | M&A | 4.65 | TVH CONSULTING | Sécurité Informatique | 2022-09 |

| DIATEM | M&A | 4.6 | GROUPE OCI | ESN : transport, stockage, mise à disposition et sécurisation de la donnée | 2022-11 |

| INTRABASES | M&A | 4.5 | MAGIC SOFTWARE ENTERPRISE | Logiciels Informatiques | 2022-11 |

| ENJOY MON CSE | M&A | 4.4 | EDENRED FRANCE | Editeur Plateforme SAAS | 2022-09 |

| BESTINFO | M&A | 4.3 | CONSTELLATION | Matériel Informatique | 2022-09 |

| DEVOLIS | M&A | 4 | SOFTFLUENT | Développement applications Microsoft (ESN) | 2022-05 |

| WAVY | M&A | 4 | TREATWELL FR | Éditeur BtoB d’un outil de gestion pour les instituts de beauté et les coiffeurs | 2022-05 |

| GROUPE PROJECT (PROJECT SI ET PROJECT PACA) | M&A | 4 | PARTHENA CONSULTANT | Solution SSI d’intégration et de distribution de services informatiques | 2022-04 |

| GHS | Fundraising | 4 | D.L.C.P. | Editeur Logiciels | 2022-02 |

| KALITI | Fundraising | 3.8 | BPI France INVESTMENT, CAPTAL ET DIRIGEANTS PARTENAIRES, ENTREPRENEUR INVEST | Éditeur de logiciel | 2022-11 |

| ROBAUT CONCEPTION | M&A | 3.7 | SILEANE | Robotique | 2022-09 |

| EQUASYS | M&A | 3.6 | FACTORIA | Infogérance | 2022-04 |

| MAPPING SUITE | M&A | 3.5 | EFALIA | Logiciels d’impression | 2022-03 |

| SOFT OUEST | M&A | 3.4 | SEPTEO | Editeur Logiciels | 2022-01 |

| SIGMA MEDITERRANEE | M&A | 3.2 | VALUE IT | SSII | 2022-02 |

| INAXEL | M&A | 3.1 | CTOUTVERT | Logiciel de gestion campings | 2022-05 |

| OCODE | M&A | 3.1 | GROUPE DUBREUIL | Marquage et protection des objets | 2022-04 |

| UntieNots | M&A | 3 | EAGLE EYE SOLUTIONS | Editeur Logiciels | 2022-11 |

| DCBRAIN | Fundraising | 3 | STATKRAFT VENTURES, BREED REPLY, ASTER | Optimisations de réseaux complexes | 2022-06 |

| INFOSEA | M&A | 3 | KOESIO (EX C’PRO) | Installation et maintenance des systèmes informatiques et téléphoniques des parcs client | 2022-05 |

| INFODREAM | M&A | 3 | CT ENGINEERING | Editeur Logiciels | 2022-05 |

| WORK WELL | M&A | 3 | SEIDOR | Infogérance | 2022-04 |

| VIDEOR INFORMATIQUE | M&A | 3 | GROUPE BAELEN (AKINEXT) | Logiciels de gestion | 2022-03 |

| SWEET PUNK | M&A | 3 | EKSTEND GROUP | Marketing Digital | 2022-02 |

| NPN | M&A | 3 | INFORMATIQUE & PREVENTION | SSII | 2022-01 |

| MANIKA | M&A | 2.9 | NEXTEDIA | Sécurité Informatique | 2022-06 |

| PRYSM SOFTWARE | M&A | 2.8 | VITAPROTECH (SORHEA ET TIL TECHNOLOGIES) | Éditeur de logiciel | 2022-01 |

| DAXIUM | M&A | 2.7 | VISIATIV|MANAGER(S) | Éditeur d’applications mobiles professionnelles | 2022-07 |

| LEAKID | M&A | 2.7 | AVISA PARTNERS | Sécurité Informatique | 2022-06 |

| NJUKO | M&A | 2.6 | ASICS CORPORATION | Editeur Logiciels | 2022-11 |

| FERWAY | M&A | 2.6 | SPARTES | Logiciel d’estimation et gestion des salaires | 2022-07 |

| OBJECTLINE | M&A | 2.6 | IT PARTNER | Intégrateur | 2022-05 |

| B-APPLI | M&A | 2.5 | PEPPERBAY | Edition et intégration de solution SaaS de gestion | 2022-07 |

| DATABACK | M&A | 2.5 | AVISA PARTNERS | SSII | 2022-06 |

| ADELYA SAS | M&A | 2.5 | OBIZ | Solutions de fidélisation et d’animation clientèle | 2022-05 |

| VOILA | M&A | 2.5 | GROUPE ORANGE|PUBLICIS GROUPE | Plateforme cloud de production d’événements | 2022-03 |

| UBIWAN | M&A | 2.43 | SAFETY SYSTEMS GROUP (COYOTE SYSTEM) | Solutions de géolocalisation permettant l’optimisation de la gestion de flotte automobile & de parc matériel | 2022-11 |

| EXOLIS | M&A | 2.3 | HOPPEN | Editeur Logiciels | 2022-05 |

| SOSERBAT | M&A | 2.29 | PARTHENA CONSULTANT | Editeur de logiciel spécialisé dans le secteur du bâtiment | 2022-11 |

| COVLINE | M&A | 2.25 | INFOLEGALE | Solutions numériques de gestion complète du poste client | 2022-05 |

| DAZL | M&A | 2.2 | MV GROUP | Transformation Digitale | 2022-11 |

| INTELLIGENT SOFTWARE | M&A | 2.2 | SEPTEO | Editeur Logiciels | 2022-10 |

| CYBERPROTECT | M&A | 2.2 | ADISTA | Sécurité Informatique | 2022-09 |

| DIOTA | M&A | 2.2 | DASSAULT SYSTEMES (3DS) | Solutions de réalité augmentée pour l’industrie. | 2022-07 |

| OKTEY (ALTOSPAM.COM) | M&A | 2.1 | PERSONNE(S) PHYSIQUE(S)|CICLAD | Sécurisation des messageries électroniques | 2022-07 |

| EXELUS (NOMADEEC) | M&A | 2.1 | ENOVACOM|ORANGE BUSINESS SERVICES | Logiciels de télémédecine avec objets connectés. | 2022-05 |

| SOWESIGN | M&A | 2 | HORIZONTAL SOFTWARE | Solution dédiée à l’émargement digitalisé | 2022-11 |

| LEGAL & DIGITAL | M&A | 2 | RSM FRANCE | Transformation Digitale | 2022-11 |

| E-AXESS | M&A | 2 | SEQUOIASOFT | Ingénierie Applicative | 2022-11 |

| FANTALEAGUE | M&A | 2 | LIGUE DE FOOTBALL PROFESS | Jeux Vidéo | 2022-11 |

| MON PETIT GAZON | M&A | 2 | LIGUE DE FOOTBALL PROFESSIONNEL (LFP) | Jeux de fantasy football | 2022-10 |

| NEOSAFE | M&A | 2 | NOMADIA GROUP. | Editeur Logiciels | 2022-09 |

| INQOM | M&A | 2 | VISMA | Editeur Plateforme SAAS | 2022-09 |

| QUASAR SOLUTIONS | M&A | 2 | KARDOL | Intégrateur logiciels | 2022-02 |

| ADJUNGO | M&A | 1.9 | BETOOBE | Fournisseur de services pour la gestion de flotte mobile | 2022-07 |

| QOWISIO | M&A | 1.8 | OCEA SMART BUILDING | Objets Connectés | 2022-11 |

| KMTX (EX KEYMANTICS) | M&A | 1.8 | SEEDTAG | Solution d’optimisation de campagnes publicitaires par l’analyse et l’utilisation des données de navigations des utilisateurs | 2022-06 |

| EURATLANTIQUE SYSTEMES | M&A | 1.8 | SYD GROUPE DIGITAL CARE | Infrastructure Systèmes | 2022-05 |

| WISEMBLY | M&A | 1.7 | MEDIACTIVE | Solution en mode Saas destinée aux réunions d’entreprise | 2022-09 |

| NEOSAFE | M&A | 1.7 | NOMADIA GROUP (GEOCONCEPT, DANEM, B&B MARKET) | Applications pour smartphones destinées à la protection des travailleurs isolés | 2022-07 |

| XEFI SAINT-CLOUD (EX-OM CONSEIL) | M&A | 1.7 | LELITE PARTICIPATIONS | Conseil et accompagnement informatique | 2022-03 |

| ACTIVITÉS DE RÉSEAUX ET CYBERSÉCURITÉ | M&A | 1.7 | ITS SERVICES | Activités de réseaux et cybersécurité | 2022-01 |

| DUST MOBILE | Fundraising | 1.6 | BPI FRANCE INVESTMENT, TIKEHAU ACE CAPITAL, OMNES CAPITAL | Opérateur mobile de cyberdéfense | 2022-11 |

| WISERSKILLS | M&A | 1.6 | NEOBRAIN | Solution de cartographie des compétences et motivations | 2022-09 |

| SIRSA | M&A | 1.6 | CORITY | Editeur Plateforme SAAS | 2022-09 |

| LOGTIMIZ | M&A | 1.6 | 4 CAD GROUP | Intégrateur Sage X3 et spécialiste de l’ERP | 2022-06 |

| AQUILAB | M&A | 1.6 | COEXYA ex SWORD FRANCE | Éditeur spécialisé dans le secteur de la santé | 2022-04 |

| ELEKTRON | M&A | 1.6 | CHAPSVISION | Cybersécurité | 2022-01 |

| MEETSYS | M&A | 1.56 | BASSETTI | Capitalisation et réutilisation des raisonnements | 2022-05 |

| INFOPARC SIP2 | M&A | 1.5 | GAC TECHNOLOGY | Logiciel de gestion de flottes automobiles | 2022-12 |

| QUANTMETRY | M&A | 1.5 | CAPGEMINI | Modélisation mathématique des données et développement de solutions technologiques IA | 2022-10 |

| LETTRIA | Fundraising | 1.5 | BPI FRANCE INVESTMENT | Plateforme spécialisée dans l’automatisation du traitement du langage naturel | 2022-10 |

| MARKETING 1BY1 | M&A | 1.5 | GROUPE POSITIVE (EX-SARBACANE) | Logiciels de marketing | 2022-10 |

| HALYS DIGITAL | M&A | 1.5 | INFOGENE | Transformation Digitale | 2022-10 |

| OCTOPUS LAB | Fundraising | 1.5 | SWEN CP, MATMUT INNOVATION, BTP CAPITAL INVESTISSEMENT, NORD CREATION, NORD FRANCE AMORCAGE | Solutions logicielles au service de la santé environnementale et de l’efficacité énergétique | 2022-07 |

| FINALCAD | Fundraising | 1.5 | CATHAY INNOVATION, SERENA CAPITAL, CAPHORN INVEST, ASTER CAPITAL | Solutions logicielles | 2022-05 |

| DEUZZI | M&A | 1.5 | VALUE IT | Infogérance | 2022-02 |

| BE BRANDON | M&A | 1.5 | EKSTEND GROUP | Marketing Digital | 2022-02 |

| ATOLIA | M&A | 1.5 | SAAS LABS | Editeur Logiciels | 2022-02 |

| SECUREWARE | M&A | 1.5 | NOVAHE | Cybersécurité | 2022-01 |

| ORFEOR | M&A | 1.4 | ANV CAPITAL (SIMCO) | Plateforme de gestion budgétaire (dette) dédiée au secteur public | 2022-01 |

| EURANOV (activité salesforce) | M&A | 1.37 | TECH’TALENTS | Solutions innovantes et accompagnement de sociétés dans leurs projets digitaux | 2022-11 |

| NEOGEO TECH | M&A | 1.3 | GEOFIT GROUPE | Solutions open source dédiées au traitement de la donnée géographique | 2022-09 |

| TANKER | M&A | 1.26 | DOCTOLIB | Solution de sécurisation des données hébergées dans le cloud | 2022-01 |

| CYBERWATCH | M&A | 1.15 | FRAMATOME (EX AREVA NP) |EDF | Cybersécurité | 2022-06 |

| PAARLY | Fundraising | 1.13 | IRDI CAPITAL INVESTISSEMENT | Spécialiste de la veille tarifaire et du repricing pour les e-commerçants et les marques | 2022-07 |

| SYNBIOZ | M&A | 1.1 | OUIDOU CONSULTING | Développement web et mobile | 2022-10 |

| KNOWLEDGE EXPERT SA | M&A | 1.08 | CAPGEMINI | Fournisseur de services en transformation digitale spécialisé dans les technologies Pega | 2022-09 |

| FOREPAAS | M&A | 1.07 | OVHCLOUD (EX-GROUPE OVH) | Plateforme unifiée de data analytics, machine learning, et d’intelligence artificielle | 2022-04 |

| DP LOGICIELS | M&A | 1.06 | SEPTEO | Éditeur de logiciel | 2022-11 |

| QUALITELIS.COM | M&A | 1 | SEQUOIASOFT | Intégrateur (CRM) | 2022-11 |

| SCOPPE | M&A | 1 | DL SOFTWARE | Editeur Logiciels | 2022-11 |

| OKINA | M&A | 1 | LUMIPLAN | Solutions informatiques pour la mobilité | 2022-06 |

| GEOLSEMANTICS | M&A | 1 | DEVERYWARE | Solution logicielle d’analyse automatisée du langage | 2022-05 |

| TILKEE | M&A | 1 | EFALIA | Solution logicielle d’optimisation prospection et relance commerciale | 2022-02 |

| VILT | M&A | n. d | TESSI | Transformation numérique | 2022-05 |

| GLOBAL MAP SOLUTION | M&A | n. d | GEOPTIS|GROUPE LA POSTE | Solution de géo-intelligence de décryptage de l’information géographique. | 2022-05 |

| KANTOX | M&A | n. d | BNP PARIBAS | Automatisation de la gestion du risque de change | 2022-10 |

| QUORSUS | M&A | n. d | CAPGEMINI | Conseil en technologie | 2022-10 |

| FABERNOVEL | M&A | n. d | EY CONSULTING | Conseil en transformation numérique et création de services innovants | 2022-07 |

| WHOZ | Fundraising | n. d | PSG EQUITY | Solutions d’Intelligence Artificielle | 2022-05 |

| INEVO | M&A | n. d | ORANO (EX NEW AREVA) | Bureau d’études techniques et d’ingénierie en procédés industrielle. | 2022-05 |

[I] Only targets with a turnover greater than €1 million