The Île-de-France-based printed circuit board technology company is stepping up its expansion. The group has just announced a €47 million financing plan to fund new acquisitions. Here are some insights from the experts at AURIS Finance, a consultancy specialising in mergers and acquisitions.

A new funding round for Icape. The French ETI, with 550 employees and a turnover of €136 million for the first 9 months of 2023, has just completed a new round of financing. In total, the group has raised €47 million, including €6 million in Relance bonds (long term financing with a state guarantee) subscribed by Tikehau Capital and €41 million in bank financing.

Setting course for Germany

This latest financing was made possible by a banking pool comprising 9 lenders: Banque Palatine, Banque Populaire Rives de Paris, BNP Paribas, Caisse Régionale de Crédit Agricole Mutuel de Paris et d’Île-de-France, Crédit Industriel et Commercial, Crédit Lyonnais, HSBC Continental Europe, Landesbank Saar, and Tikehau Capital. Initially, Icape’s banking pool consisted of four banking partners. With this transaction, the global card technology distributor is opening up to a German bank, a market in which Icape already has a strong presence. In June 2023, Icape acquired the German IC distributor HLT. This followed a series of acquisitions in Germany, one of the world’s leading markets.

Seven acquisitions in 2023

In 2020, Icape took over the German company Safa, before acquiring Swedish (MMAB), Danish (Mon Print) and Portuguese (Luso Dabel) companies. In 2023 alone, Icape took over seven companies in the integrated circuit sector in France, Germany and the United States, with the declared aim of acquiring a turnover of €120 million by 2026. Icape is now present in twenty-two countries and intends to strengthen its position in the most dynamic markets, such as France, Germany and the United States. To achieve this, the French specialist will continue its strategy of integrating inorganic operations with organic growth. New takeovers are already under consideration and could be completed by 2024.

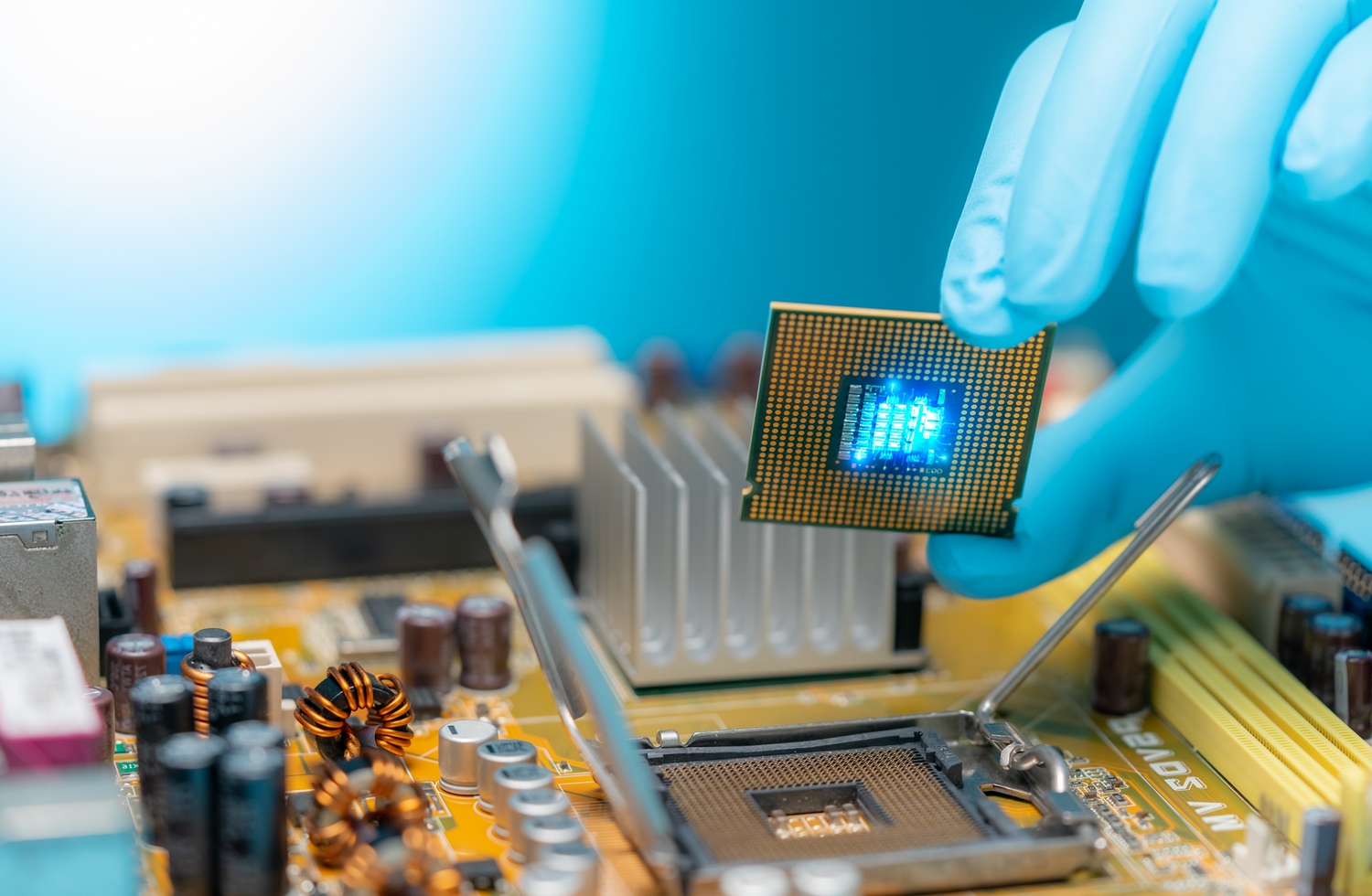

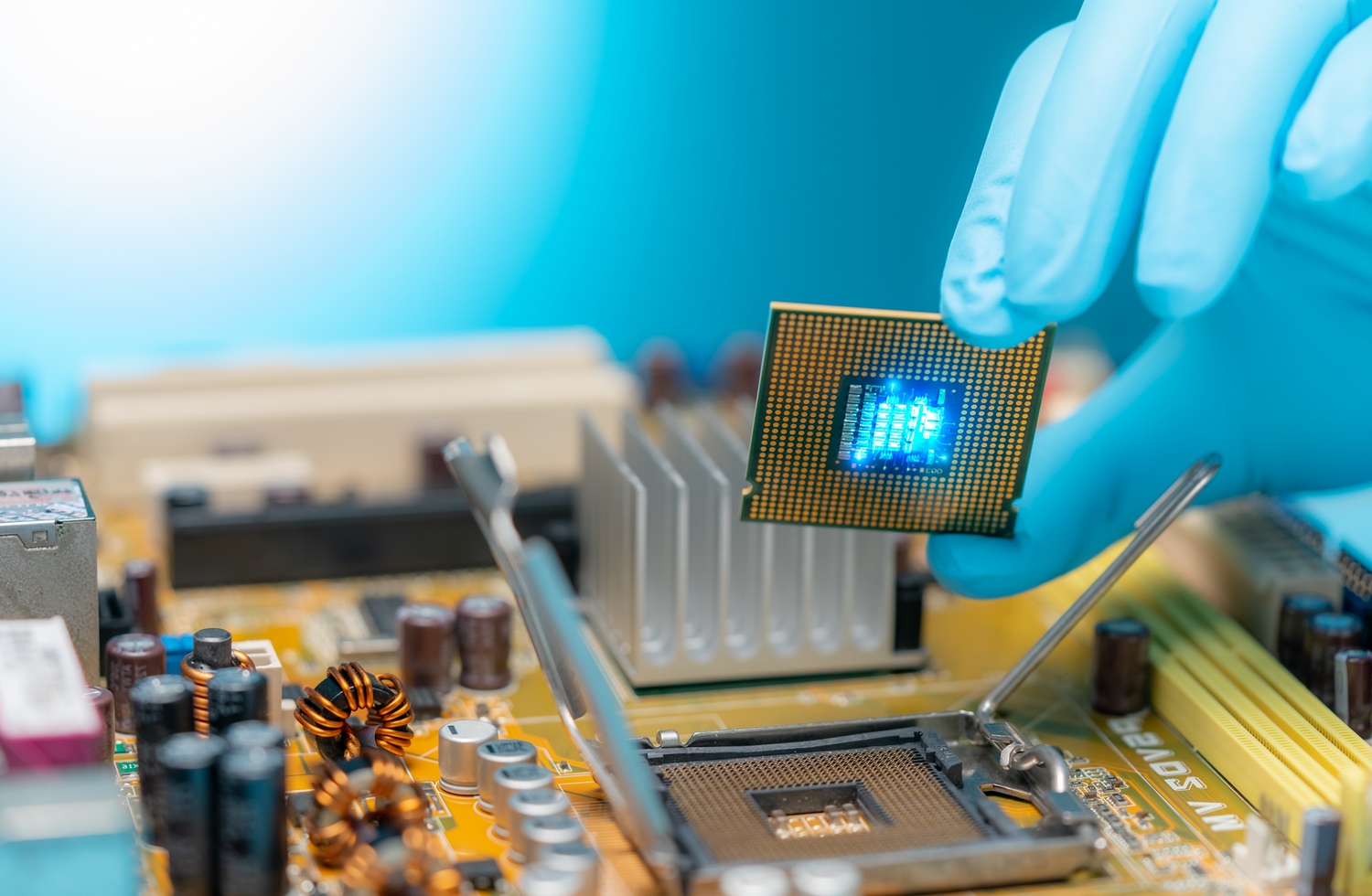

A fast-growing industry

Icape has been on an acquisition spree to carve out a place for itself in a fast-growing market. Demand for integrated circuits is growing, driven by the automotive, home automation, telecommunications, aerospace, and medical industries. At the same time, raw material scarcity is intensifying competition between manufacturers. Europe is struggling to keep up and currently holds just 6% of the global market for integrated circuits. The old continent lags far behind South Korea, Japan and Taiwan. To survive in a fiercely competitive sector, specialists in the field need to move fast and, like Icape, embrace cutting-edge technologies to stay in the race for innovation.

Our experts at your side

Innovative technology companies continue to be closely watched by large corporations looking to quickly gain new market share. AURIS Finance has a department dedicated to technology and engineering companies. We will work with you in your search for financial partners and support you in your sale and acquisition projects.