Is there room for local, sustainable and responsible alternatives to the giants of the mass consumer goods sector? That’s the challenge facing SME Héritage, which has acquired several brands in three years, including Bonux washing powder. Here are some explanations from the experts at AURIS Finance, a consultancy specialising in mergers and acquisitions.

Although Héritage is a young company (founded in 2021), it has a portfolio of historic brands. These include well-known brands such as Bonux detergent, Vigor intensive cleaners, Décap’four, Terra and Miror, Baranne shoe polish and Minidou fabric softener.

Heritage brands

In total, Héritage owns eight consumer brands. What they all have in common is that they were once brands loved by the French public. Some have been forgotten, others struggled to survive until they were acquired. In creating Héritage, the founders set out to revive emblematic French brands with a focus on Made in France. The project is the brainchild of Daniel Chassagnon and Richard Lerosey, two entrepreneurs who previously founded and sold Swania, an eco-friendly detergent company. In 2021, they sold Swania, which had an annual turnover of €45 million, to the German giant Henkel.

A truly French SME

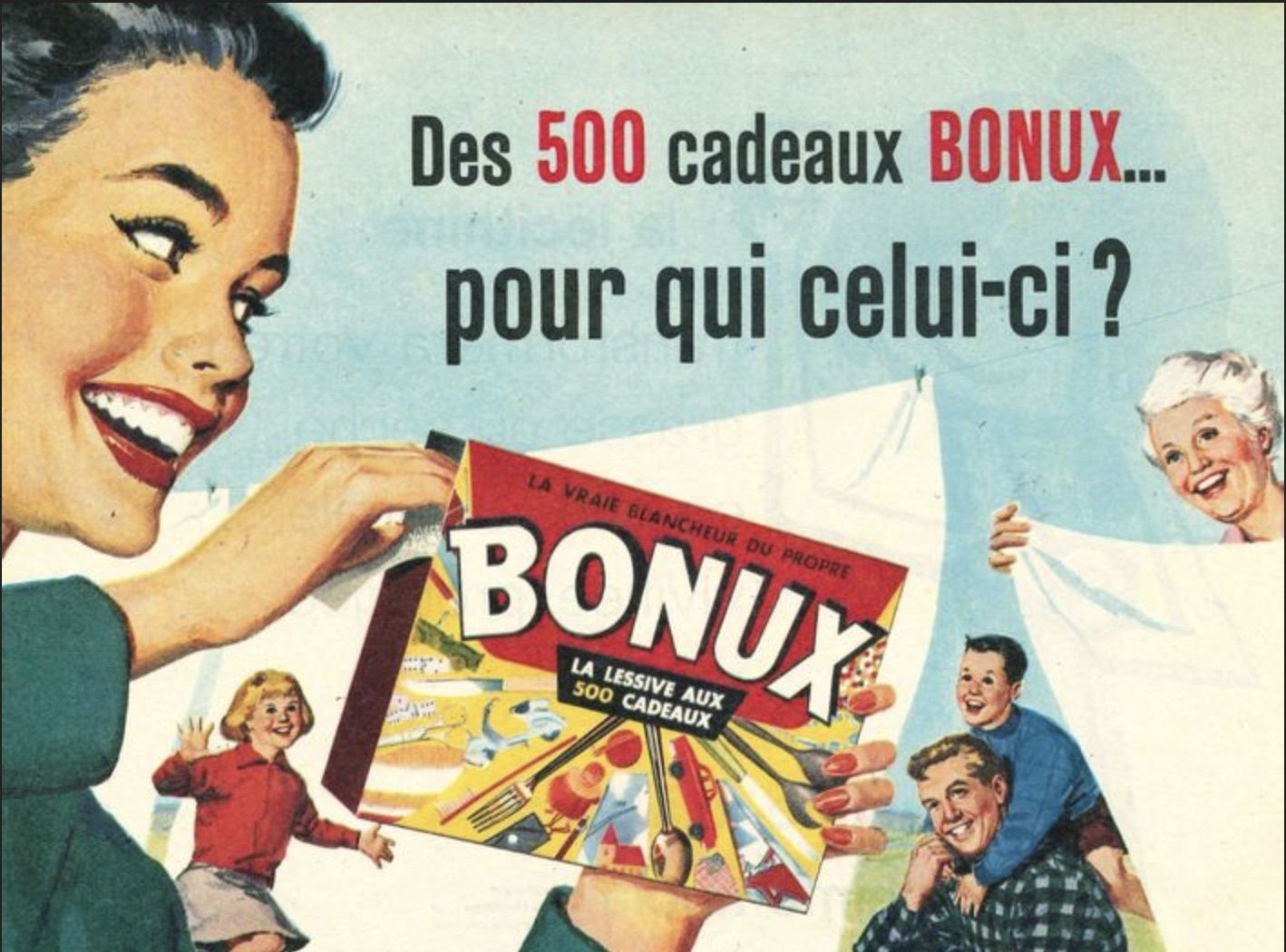

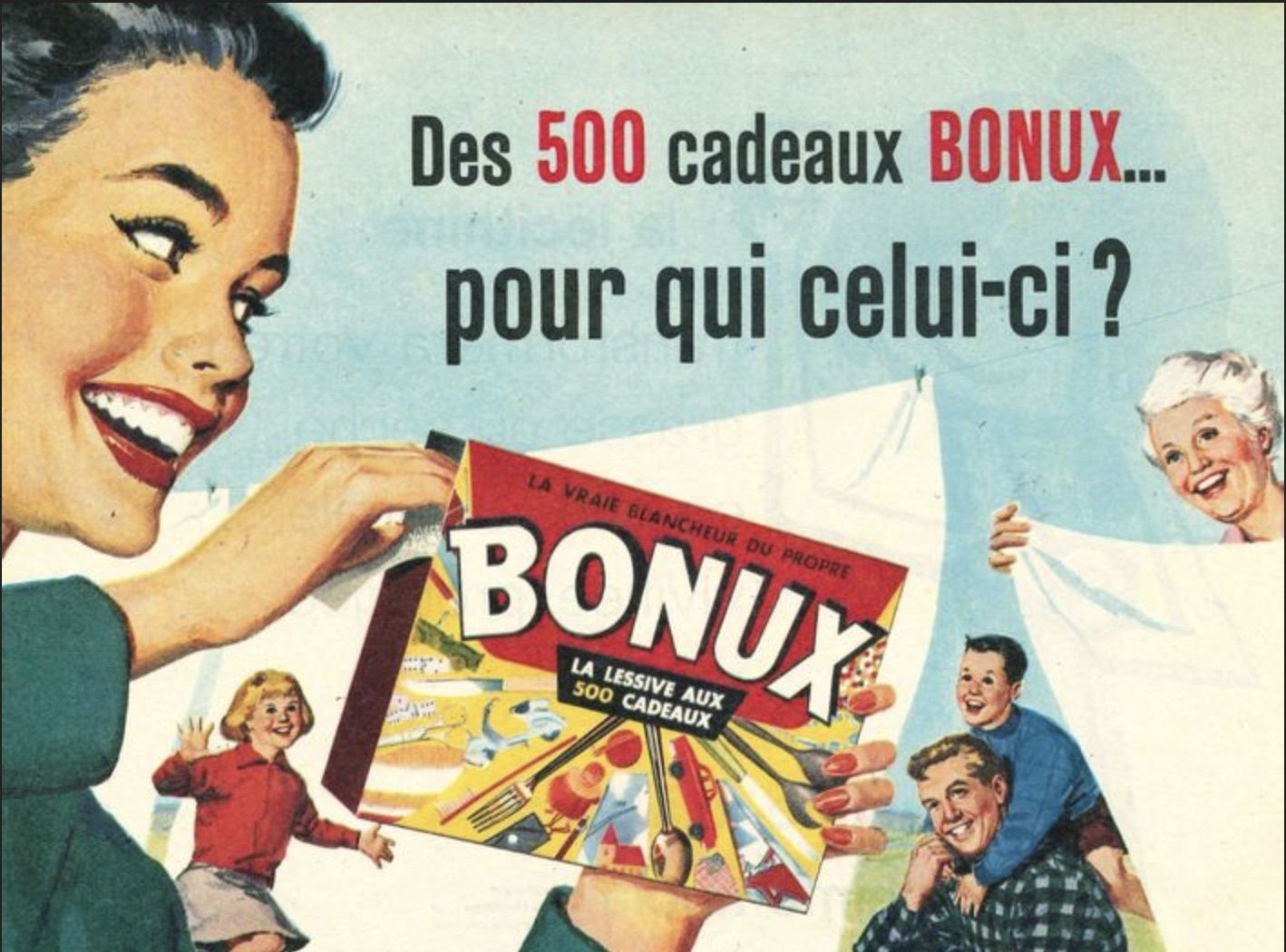

They then embarked on a strategy of buying up ‘heritage’ brands, i.e. those easily recognisable by French consumers. Bonux was created in 1958 by the giant Procter & Gamble and then sold to other manufacturers in the sector. In 2023, Héritage acquired the washing powder brand from the German group Dalli. Production was then transferred entirely to France, to Sopronem in Seine-et-Marne and VDP in Boulogne-sur-Mer. At that time, 80% of production was carried out in France, a percentage that the company intends to increase over the years.

Marketing strategy

Héritage then implemented a marketing strategy based on the emotional response of consumers and reintroduced the “Bonux gift”. The results were immediate: within a year, Bonux had won over 400,000 consumers and achieved a 1% share of the washing powder market in France. With its eight brands, the company achieved sales of €30 million in 2023, compared with €20 million the previous year. The target is now €50 million by 2027. Héritage’s strategy is to target people in their forties, playing on the nostalgia factor, but also a younger demographic with a taste for Made in France products and a commitment to the environment. To achieve this, the group has adopted a more responsible approach to production, redesigning formulas to eliminate allergenic and irritating ingredients. To meet consumer expectations, the brand has also made its laundry detergent available in liquid and capsule formats.

Our experts at your service

Other cleaning specialists are positioning themselves on the Made in France market. This is the case of sector leader Altaïr, which took over the Briochin group in 2021. The group, owner of the Starwax and Kapo brands, has become France’s leading supplier of traditional household cleaners in just a few years, with sales of €180 million in 2023.

Like those of the Altaïr and Héritage groups, there are success stories, even in a market that at first glance appears saturated. The experts of AURIS Finance specialise in different industries. Our Consumer Products team will help you structure your operations. Whether you are an acquirer looking for a target or a seller looking for a financial partner, our experts are at your side.