Tight macroeconomic environment

After a year of strong growth in 2021 as the health crisis came to an end, 2022 was marked by a slowdown in economic growth (+2.6% compared with +6.8% in 2021 according to the Banque de France’s macroeconomic projections). The expected difficulties (“bottlenecks” in supply and production chains, rising inflation) were exacerbated by global geopolitical tensions at the beginning of the year, which led to a further escalation of the energy crisis. Central banks responded to rising inflation by raising interest rates (+425 bps for the FED, +250 bps for the ECB) to address the cost of living crisis. These macroeconomic factors had a strong impact on French companies and the cleaning sector.

Current trends affecting the cleaning sector

The hybridisation of work popularised during the health crisis is set to continue, reducing the need for office cleaning services. This demand is also affected by the increased vacancy rate in commercial premises during this difficult period for businesses.

Despite the downward trend, some sectors continue to have high cleaning requirements. These include the healthcare sector, where outsourcing of hygiene and cleaning tasks is still low. The wave of factory start-ups in 2021 also presents opportunities for industrial cleaning, where outsourcing is on the rise.

Multi-service groups are further expanding their offerings, enabling them to maintain sustainable growth. Growth is more limited for very small companies, whose services are less differentiated and targeted at the tertiary sector. In 2021, these players had already underperformed compared to the sector as a whole (+7.4% of turnover against +9.3%).

The sector’s activity is price-sensitive, as contracts are linked to salaries. As wages follow inflation, they will be significantly revalued in 2022, pushing up the rates for services. There will also be an increase in the base level in 2022, when the minimum wage will rise by 5.63 %. The contractual minimum for the first level of classification (AS1) is 2.6% higher than the French minimum wage as of 1 April 2022 (FEP 2022). In addition, the difficulty for cleaning companies to recruit staff strengthens the power of workers in wage negotiations.

Future challenges

Training is an essential step in boosting employment in the sector. Professional Qualification Certifications, which were awarded to more than 35,000 apprentices last year, are available on a work/study basis. This need for training is giving rise to initiatives such as ONET University, created by the multi-service giant as a priority place to recruit qualified staff. Others, such as the STEM Group, which has set up an e-learning platform, are turning to innovative learning solutions.

Digital technology is also an important area of development for the cleaning sector. Major groups are using it, such as DERICHEBOURG, which has launched a series of apps for employees and customers. ELIOR has launched an occupancy tracking solution based on NFC tags, while GSF is promoting the integration of robots to work alongside cleaners during their shifts.

A growing number of players in the sector are also focusing on CSR. This commitment is a strong part of their brand image and a source of differentiation. Social responsibility is at the heart of many clients’ needs. In an effort to give credibility to these initiatives, labels such as AFNOR’s “Commitment to CSR” are being created.

Review of mergers and acquisitions

2022 was marked by two major transactions involving leading French and international players, demonstrating the dynamism of the sector. Two American investment funds, CD&R and TOWERBROOK, have each taken control of two French champions in services to companies and the cleaning sector: ATALIAN and GSF respectively. These two groups have revenues in excess of €1 billion and represent 99% of the combined turnover of the targets in this year’s transactions. Among the transactions announced at the end of the year, the merger between DERICHEBOURG MULTISERVICES and ELIOR (cumulative turnover of €5 billion) is also attracting a lot of attention.

As for the small and mid-cap players in the sector, they are relying on external growth to develop their activities during this period of contraction. In addition to the changing needs of the sector, the difficulty of recruiting staff is an obstacle to internal growth. Among the small- and mid-cap operations, we find notable transactions carried out by BEAUTIFUL LIFE SERVICES, ECOCLEAN SERVICES, or the NSI group.

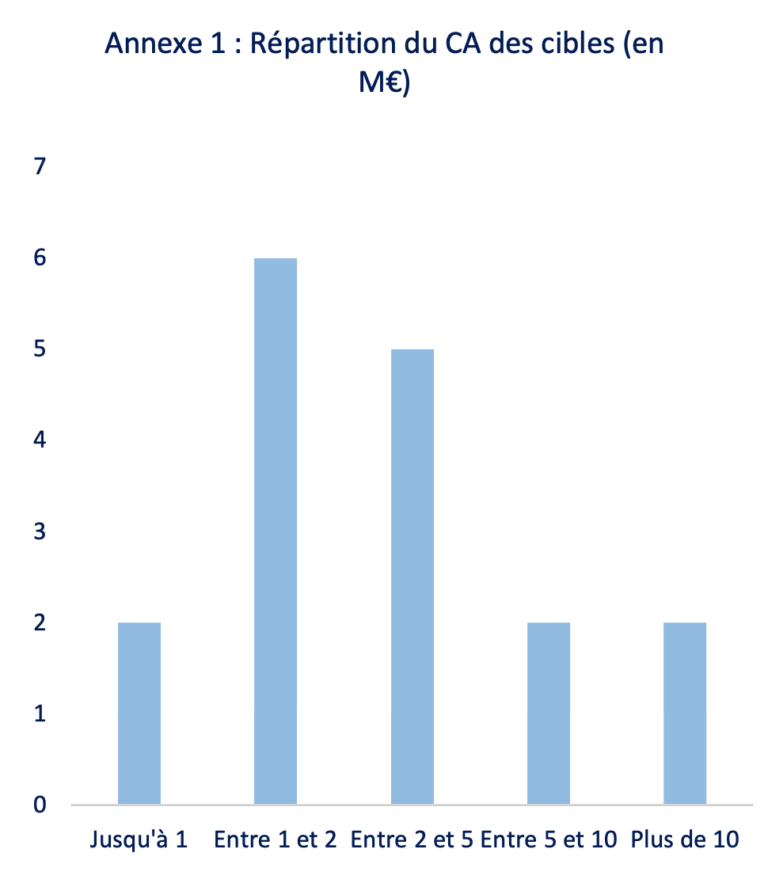

Overall, target companies with a turnover between €1 million and €10 million accounted for two-thirds of all transactions. (see Annex 1).

Up to 1, Between 1 and 2, Between 2 and 5, Between 5 and 10, Over 10

Leaving aside the two major deals in 2022, the rest of the targets recorded €43 million in turnover.

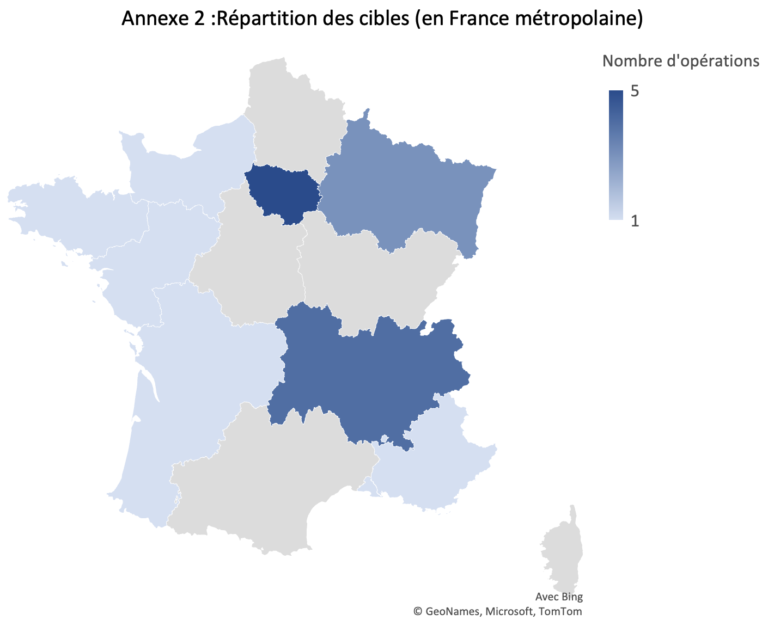

These transactions are spread throughout France, with a marked concentration in the Île de France, Grand Est and Auvergne-Rhône-Alpes regions (see Appendix 2).

With more than 50% of the metropolitan workforce, these three regions also lead the way in terms of employment (including 32% in Île-de-France, according to ACOSS).

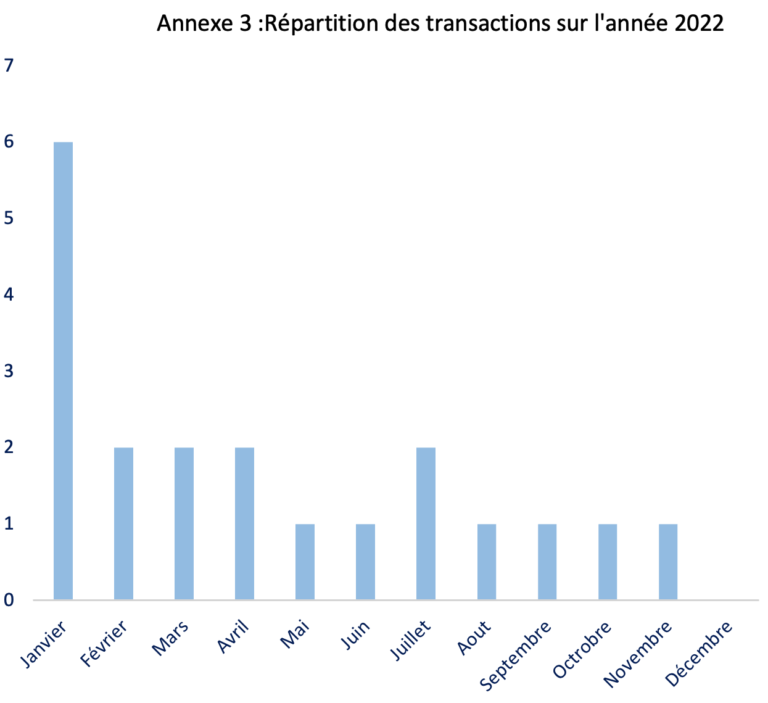

Finally, the gradual increase in interest rates by central banks is slowing down financing and directly affecting the number of transactions worldwide (-37% according to Dealogic data analysis). In addition, 45 % of the transactions on our list were completed in the first quarter of 2022 (see Appendix 3).

January, February, March, April, May, June, July, August, September, November, December

| Transaction date | Target company | Location | Buyer | Target company Sales Revenue |

|---|---|---|---|---|

| 2022-01 | HYPSO | Grand Est | EURONET PROPRETE ET SERVICES | 1,5 M€ |

| 2022-01 | ACTION PROPRETE | Grand Est | EURONET PROPRETE ET SERVICES | 0,9 M€ |

| 2022-01 | STEAM | Auvergne-Rhône-Alpes | GROUPE BEAUTIFUL LIFE | 5 M€ |

| 2022-01 | GROUPE HAON | Auvergne-Rhône-Alpes | NSI GROUPE | 4 M€ |

| 2022-01 | EUROPE ENTRETIEN | Île-de-France | GROUPE EMN | 1,2 M€ |

| 2022-01 | PROXY SERVICES | Île-de-France | ECOCLEAN SERVICES | 3,8 M€ |

| 2022-02 | ATMNI | Normandie | GROUPE ORTEC | 6,2 M€ |

| 2022-02 | LC GARCIA | Île-de-France | PRO VIREM | 1 M€ |

| 2022-03 | ABC ENTRETIEN | La Réunion | Groupe LSB | 10 M€ |

| 2022-03 | GROUPE SERVICES FRANCE | Provence-Alpes-Côte d’Azur | TOWERBROOK CAPITAL PARTNERS | 1 098 M€ |

| 2022-04 | MEP PROPRETE | Pays de la Loire | GROUPE ODEN | 2 M€ |

| 2022-05 | GROUPE ATLANTIQUE SERVICES | Nouvelle-Aquitaine | DERICHEBOURG PROPRETE | 5 M€ |

| 2022-06 | VSB SERVICE | Auvergne-Rhône-Alpes | AKESA – GROUPE EPI | – |

| 2022-07 | SENET LYON (service à la personne) | Auvergne-Rhône-Alpes | OUI CARE COMMUNICATION | 1,3 M€ |

| 2022-07 | ISS FACILITY SERVICE PORTUGAL | Portugal | SAMSIC | – |

| 2022-08 | SERVICIOS INDUSTRIALES REUNIDOS | Espagne | SAMSIC | – |

| 2022-09 | ATALIAN | Île-de-France | CD&R | 3 000 M€ |

| 2022-09 | AZUR NETTOYAGE | Région Bretagne | GROUPE EMN | 0,9 M€ |

| 2022-10 | NB2I | Grand Est | STEM PROPRETE | 1 M€ |

| 2022-11 | PRESTNET | Île-de-France | GROUPE EMN | 2,2 M€ |